IRS Tax Resolution Services in Miami, FL: Local CPA Guidance You Can Trust

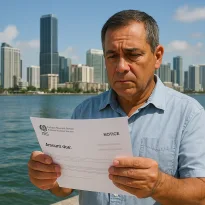

Miami is a city of opportunity, energy, and international business. From small family-owned restaurants in Little Havana to global trade firms near the Port of Miami, financial life here is vibrant and diverse. But with that diversity comes complexity — and for many residents, an unexpected letter from the IRS. Whether it’s a CP14 balance due, a CP2000 mismatch notice, or a full-blown audit, IRS communication can shake even the most confident taxpayer. This is where IRS tax resolution services in Miami, FL become not just useful, but essential. And having an experienced CPA in Miami, FL by your side ensures that you don’t face the IRS alone.

Understanding Why Miami Residents Receive IRS Notices

Miami taxpayers face unique challenges that make them frequent targets for IRS scrutiny. Common triggers include:

- International income reporting — With Miami’s close ties to Latin America and the Caribbean, many residents earn income abroad. Failing to report it correctly can lead to IRS letters and penalties.

- Real estate transactions — Selling condos, rental properties, or vacation homes without reporting basis or depreciation properly often triggers mismatched 1099-S forms.

- Gig economy earnings — Uber drivers, artists, and freelancers often juggle multiple 1099s that don’t align perfectly with IRS records.

- Crypto investments — Miami’s booming cryptocurrency scene has drawn attention from the IRS, which now requires detailed reporting on digital assets.

- Small business payroll issues — Restaurants, shops, and construction companies in Miami sometimes fall behind on payroll taxes, leading to trust fund recovery penalties.

When a notice arrives, many residents assume the worst. In reality, most IRS letters are not accusations of fraud, but requests for clarification. The key is knowing how to respond strategically.

First Steps for Miami Taxpayers Receiving IRS Letters

If you’ve received a notice, here are the immediate steps every Miami resident should take:

- Read carefully — Identify the letter type (CP14, CP2000, CP504, audit notice) and note the deadlines.

- Pull IRS transcripts — Transcripts reveal exactly what the IRS has on file for you, including income, payments, and account balances.

- Organize documentation — Collect W-2s, 1099s, brokerage statements, and receipts before responding.

- Avoid rushed responses — Calling the IRS unprepared can lock you into statements that make your case harder later.

- Contact a CPA in Miami, FL — A local professional understands both the tax code and the Miami IRS office procedures.

The Miami Audit Experience

Audits come in three forms, and each requires different handling:

- Correspondence Audit — Done by mail. Common for small mismatches, like underreported dividends.

- Office Audit — Usually held at the IRS office in downtown Miami. Taxpayers are asked to bring records for review.

- Field Audit — IRS agents visit your home or business. Rare but serious, often involving larger amounts or suspected underreporting.

In every case, you have the right to representation. Many Miami taxpayers never speak to the IRS directly once they hire a CPA to represent them.

The Miami Audit Experience: What Residents Should Know

For many taxpayers in Miami, the word “audit” sparks anxiety and confusion. The IRS audit process can feel intimidating, but understanding how audits unfold in Miami, FL helps reduce fear and prepares you to respond effectively. Whether you’re a retiree in Coconut Grove, a small business owner near Brickell, or a gig worker in Little Havana, knowing what to expect is the first step toward a successful outcome. This is where IRS tax resolution services in Miami, FL and the guidance of a seasoned CPA in Miami, FL become invaluable.

How Audits Begin

IRS audits typically begin with a letter. For Miami residents, this notice may request clarification about income, deductions, or credits. Common triggers include mismatched 1099s, large charitable contributions, or complex real estate transactions. Miami’s unique mix of international trade, foreign income, and investment activity makes residents more likely to experience red flags in IRS systems. The audit letter will specify whether the review is a correspondence audit, office audit, or field audit.

Correspondence Audits

The most common type for Miami taxpayers, correspondence audits are handled by mail. The IRS may ask for documentation such as brokerage statements, proof of rental expenses, or receipts for deductions. While these seem simple, sending incomplete or confusing responses can make things worse. Professional IRS tax resolution services in Miami, FL ensure that every piece of evidence is properly presented to strengthen your case.

Office Audits in Downtown Miami

For more detailed reviews, the IRS will schedule an appointment at the downtown Miami IRS office, located near major business centers. Here, taxpayers are expected to appear with extensive records. Office audits often focus on small businesses, landlords, or self-employed professionals. Having a CPA in Miami, FL attend on your behalf can make the process less stressful and more effective, as professionals know how to navigate the procedures and present your information in a clear, structured way.

Field Audits: The Most Serious

Field audits occur when IRS agents visit your home or business in Miami. These are less common but far more serious, often involving significant income discrepancies or suspected underreporting. The IRS may review books, bank statements, and even inventory. Without skilled representation, field audits can quickly escalate. A trusted CPA in Miami, FL serves as your shield, handling communications, ensuring compliance, and pushing back against overreach when necessary.

Your Rights During an Audit

Many Miami residents don’t realize they have rights during an audit. The Taxpayer Bill of Rights guarantees the right to representation, the right to privacy, and the right to appeal IRS decisions. By working with local IRS tax resolution services in Miami, FL, you gain an advocate who protects these rights at every stage.

Practical Tips for Miami Audits

- Never attend an audit meeting without preparation or professional support.

- Keep your records organized year-round, especially for rental or business income.

- Respond promptly to all IRS deadlines — delays can increase penalties.

- Use transcripts to confirm what the IRS already knows before submitting documents.

The Miami audit experience doesn’t have to be a nightmare. With expert guidance, clear strategy, and the support of a qualified CPA in Miami, FL, even the most complex audits can be resolved fairly. Residents who take action early and seek professional help often find that the process ends with far less damage than they feared, allowing them to focus once again on enjoying life in Miami’s vibrant community.

Resolution Options for Miami Residents

A skilled CPA in Miami, FL can evaluate which IRS resolution path fits your circumstances:

- Installment Agreements — Spread payments over time to avoid levies.

- Offer in Compromise — Settle your tax debt for less if you qualify under IRS financial guidelines.

- Penalty Abatement — Remove penalties for reasonable cause or first-time mistakes.

- Currently Not Collectible Status — Pause IRS collections if you demonstrate financial hardship.

- Audit Reconsideration — Reopen an audit with new evidence or corrections.

Case Study: A Miami Entrepreneur

Carlos’s Case: How a Miami Entrepreneur Avoided Financial Disaster

Carlos, a successful entrepreneur in Miami’s import/export industry, was living what many would consider the dream. His business connected Florida suppliers with partners across Latin America, and his reputation in the community was strong. Then one morning, everything changed. He received a thick envelope from the IRS containing a CP2000 notice alleging he had underreported $90,000 in income. The proposed tax, penalties, and interest totaled more than $140,000. To make matters worse, the letter warned that if the balance remained unresolved, enforcement actions — including potential passport restrictions — could follow.

The news hit Carlos hard. International travel was at the heart of his business model. Without his passport, he couldn’t attend trade shows in Bogotá, negotiate contracts in Caracas, or meet with shipping agents in Panama. The idea that a single IRS notice could shut down his entire livelihood filled him with dread. He feared not only losing his business, but also disappointing his employees and family who depended on him.

Rather than acting rashly, Carlos contacted a me, a CPA in Miami, FL with experience in IRS tax resolution services in Miami, FL. The first step was to order transcripts from the IRS. These records revealed the root of the problem: income from one of his Venezuelan clients had been reported twice. A 1099 form from a U.S.-based affiliate overlapped with documents filed directly from the foreign client, effectively doubling the revenue on the IRS’s system. To the IRS computers, it looked like Carlos had failed to report nearly six figures in taxable income.

Armed with this discovery, the CPA prepared a thorough response package. It included detailed explanations, reconciled accounting records, and supporting documents from both the foreign and domestic entities. The CPA also highlighted the devastating consequences of the incorrect assessment — if left uncorrected, Carlos’s balance due would not only cripple his cash flow but could trigger certification to the State Department for passport revocation. For an international entrepreneur, that would have been catastrophic.

The process wasn’t instant. It required multiple rounds of communication, patience, and careful presentation. But eventually, the IRS agreed. After reviewing the evidence, they conceded that the $90,000 had been reported twice and reduced Carlos’s liability by more than 85%. The balance, once a terrifying six-figure sum, fell to a manageable amount tied only to legitimate earnings.

For Carlos, the outcome was life-changing. His passport was safe, his business could continue operating across borders, and his reputation remained intact. The case illustrates how quickly an IRS notice can spiral into an existential threat for Miami residents whose work depends on international travel. It also shows how effective IRS tax resolution services in Miami, FL can be when led by a skilled CPA who understands both the tax code and the realities of living and working in Miami’s global economy.

Carlos’s story is a reminder that IRS letters are not always accurate, and that panic is never the answer. With the right transcripts, supporting documentation, and professional advocacy, what looks like financial disaster can become a manageable setback — one that allows you to protect your business, your passport, and your peace of mind.

Miami’s Unique Tax Landscape

Unlike many cities, Miami’s tax challenges often involve cross-border income, real estate, and high-value transactions. Add in a diverse workforce with many independent contractors, and you have the perfect recipe for IRS confusion. Local expertise is critical because a CPA in Miami, FL understands both federal requirements and the patterns that appear again and again for Miami taxpayers.

Frequently Asked Questions

Do Miami retirees get targeted by the IRS?

Yes. Retirees with multiple income sources — Social Security, IRAs, and foreign pensions — often receive mismatched reporting notices. IRS tax resolution services in Miami, FL help untangle the records and protect retirement income.

Can crypto investors in Miami face audits?

Absolutely. Miami’s reputation as a “crypto hub” means the IRS watches closely. If you received a letter about digital assets, consult a CPA in Miami, FL who understands both tax code and cryptocurrency reporting.

What if I can’t pay the full amount owed?

You have options. From payment plans to Offers in Compromise, IRS tax resolution services in Miami, FL can negotiate terms that fit your budget while stopping aggressive collection actions.

Can the IRS garnish my wages in Miami?

Yes. Wage garnishments are a common enforcement tool. A CPA in Miami, FL can act quickly to prevent or lift garnishments through proper negotiation.

Why hire a local CPA instead of a national tax relief company?

Local CPAs in Miami, FL offer face-to-face meetings, bilingual services, and direct representation at the downtown Miami IRS office. National companies often rely on call centers and scripted solutions, leaving clients underserved.

Final Thoughts

Receiving an IRS letter can feel overwhelming, but with the right help, it doesn’t have to derail your life. IRS tax resolution services in Miami, FL exist to protect your income, safeguard your assets, and restore your peace of mind. By working with a trusted CPA in Miami, FL, you gain not only expertise but also an advocate who understands the unique challenges Miami residents face.

Call to Action

If you’ve received an IRS notice, audit request, or balance due statement, act now. Don’t wait until the IRS escalates. Contact a CPA in Miami, FL today for a confidential consultation and take the first step toward resolving your IRS issues.

Frequently Asked Questions About IRS Tax Resolution Services in Miami, FL

1. Why do Miami residents receive more IRS audit notices than other cities?

Miami is a global business hub with heavy international trade, real estate transactions, and cross-border investments. These activities often generate complex reporting requirements that the IRS monitors closely. For example, foreign income, rental property sales, and cryptocurrency gains frequently trigger mismatch letters like the CP2000. Engaging IRS tax resolution services in Miami, FL ensures that these complexities are addressed before they snowball into penalties or audits.

2. Can the IRS revoke my passport if I live in Miami?

Yes. If you owe more than $62,000 in seriously delinquent tax debt, the IRS can certify your account to the State Department, which may deny renewal or even revoke your passport. This is particularly dangerous for Miami residents who rely on international travel for business. A CPA in Miami, FL can intervene early, negotiate a payment plan or Offer in Compromise, and prevent your case from reaching the certification stage.

3. What role do IRS transcripts play in resolving Miami tax cases?

IRS transcripts are a taxpayer’s roadmap. They show exactly what income documents the IRS has received, what payments have been credited, and what balances remain. In Miami, where many residents deal with multiple income streams, transcripts often reveal duplicate 1099s, misclassified foreign earnings, or overlooked payments. IRS tax resolution services in Miami, FL use transcripts as the foundation for challenging incorrect notices.

4. How do audits differ in Miami compared to other regions?

While audits follow the same federal procedures nationwide, Miami taxpayers are more likely to encounter scrutiny around international income, high-value property sales, and digital assets. Office audits are typically scheduled at the downtown Miami IRS office, while field audits may involve in-person visits to businesses in areas like Wynwood, Brickell, or Doral. Representation by a CPA in Miami, FL ensures your audit is handled strategically, with local knowledge of IRS office procedures.

5. What should I do if I receive a CP2000 notice in Miami?

A CP2000 is not a bill — it’s a proposed adjustment based on mismatched records. Do not panic or immediately agree. Miami taxpayers often discover that income was double-reported or misreported by financial institutions. A CPA in Miami, FL can compare the notice against your transcripts, gather supporting documents, and file a response that protects your finances.

6. Can Miami small business owners get into trouble with payroll taxes?

Yes, and this is a common issue. Failing to deposit or report payroll taxes properly can lead to trust fund recovery penalties, which are personally assessed against business owners. Restaurants, construction companies, and import/export firms in Miami frequently face this problem. IRS tax resolution services in Miami, FL help negotiate payment plans and prevent the IRS from targeting your personal assets.

7. How do Offers in Compromise work for Miami taxpayers?

An Offer in Compromise allows you to settle your debt for less than the total owed. The IRS considers your income, expenses, and assets. Miami residents with high property values or offshore accounts may face more scrutiny, but a skilled CPA in Miami, FL can structure an offer that reflects your true financial condition and maximizes your chance of approval.

8. What is Currently Not Collectible status, and how does it help Miami residents?

If you can prove that paying your tax debt would cause financial hardship, the IRS may mark your account as Currently Not Collectible. This halts levies and garnishments, though interest continues to accrue. In a high-cost city like Miami, many residents qualify due to housing and family expenses. IRS tax resolution services in Miami, FL prepare the detailed financial forms needed to secure this protection.

9. Are Miami real estate investors more likely to be audited?

Yes. The IRS pays close attention to property sales, depreciation schedules, and rental income. Miami’s active condo and short-term rental market creates opportunities for mistakes. If records are incomplete, audits can quickly escalate. A CPA in Miami, FL familiar with local real estate patterns ensures compliance and defends you if audited.

10. What happens if I ignore my IRS debt in Miami?

Ignoring your IRS debt leads to escalating enforcement: liens on Miami property, levies on bank accounts, garnishment of wages, and possible passport certification. These actions can devastate both personal finances and business operations. Working with IRS tax resolution services in Miami, FL immediately stops the spiral and puts you back in control.

11. How can Miami crypto investors avoid IRS penalties?

The IRS requires reporting of all crypto transactions, whether you traded on exchanges or used digital assets for purchases. Miami’s crypto-friendly culture has led to increased IRS scrutiny. Failure to report can trigger audits and severe penalties. A CPA in Miami, FL experienced in crypto tax law can ensure accurate filings and defend against IRS challenges.

12. Does bilingual support matter in Miami tax cases?

Yes. Many Miami residents are Spanish-speaking, and IRS documents are rarely translated. Misunderstandings can lead to missed deadlines or incorrect responses. Choosing IRS tax resolution services in Miami, FL with bilingual support ensures that nothing is lost in translation and that taxpayers fully understand their rights and responsibilities.

13. How does a CPA in Miami, FL handle international clients differently?

International clients often have reporting requirements under FATCA, FBAR, and other regulations. Errors in foreign account reporting can result in penalties even greater than the tax due. A CPA in Miami, FL with international tax experience can reconcile foreign income, properly file FBAR reports, and defend you if the IRS challenges cross-border transactions.

14. What is the timeline for resolving IRS debt in Miami?

Timelines vary based on the case. Simple CP2000 responses may resolve within months, while Offers in Compromise or audit reconsiderations may take a year or more. Miami residents should act quickly to avoid additional penalties and interest. Engaging IRS tax resolution services in Miami, FL early can shorten timelines and improve outcomes.

Helpful Government Resources for Miami Taxpayers

IRS Letters & Notices

- Understanding Your IRS Notice or Letter

- What to Do When an IRS Letter Arrives

- CP14 – Balance Due Notice

- CP2000 – Underreported Income Notice

Transcripts, Accounts & Secure Uploads

Audits, Appeals & Reconsideration

- IRS Audits Overview

- Publication 556 – Examination of Returns & Appeal Rights

- Publication 3598 – Audit Reconsideration (PDF)

- IRS Independent Office of Appeals

Collections, Payments & Relief Options

- Payment Plans / Installment Agreements

- Apply for an Online Payment Agreement

- Offer in Compromise (Settle for Less)

- Form 656 Booklet – Offer in Compromise (PDF)

- Publication 594 – The IRS Collection Process (PDF)

- Currently Not Collectible (Hardship)

Penalty Relief & Appeals

Passports & Seriously Delinquent Tax Debt

- IRS: Passport Revocation/Denial for Unpaid Taxes

- U.S. Department of State: Passport Denial/Revocation

International & Offshore Reporting (Miami-Relevant)

- FATCA Compliance

- FBAR – Report of Foreign Bank Accounts

- FinCEN BSA E-Filing System

- Streamlined Filing Compliance Procedures

- Digital Assets (Crypto) – IRS Guidance

Taxpayer Rights & Local Help

- Taxpayer Bill of Rights

- Taxpayer Assistance Center Locator (Find Miami Office)

- Contact Your Local IRS Office

- Taxpayer Advocate Service – Contact TAS

- Low Income Taxpayer Clinics (Program)

- Publication 4134 – LITC List (PDF)