When the Florida Department of Revenue (DOR) sends a payroll tax audit notice, business owners in Miami often feel blindsided. Payroll taxes—sometimes called reemployment or unemployment compensation contributions—carry strict reporting rules, and even a minor slip can set off a formal investigation. With over two decades of experience defending businesses against Florida DOR payroll audits, I’ve seen how quickly these situations escalate.

This article walks you through what actually happens during a payroll tax audit in Florida, why your company might have been selected, the type of records the state expects, and how an experienced CPA can help you navigate the process.

Why Florida DOR Looks Closely at Employer Payroll Records

Florida’s DOR doesn’t audit randomly. They are tasked with making sure every employer in the state pays the proper share of reemployment tax and files accurate quarterly reports. Several triggers can put your Miami business under scrutiny:

- A mismatch between the wages you reported and what employees filed on their returns

- Consistent late filings or missing reports

- Worker classification concerns (1099 contractors vs. W-2 employees)

- Whistleblower tips or complaints

- Industry-specific sweeps, where the DOR reviews multiple businesses in the same sector

From my experience, once the state believes your filings don’t add up, they rarely back down without a thorough review.

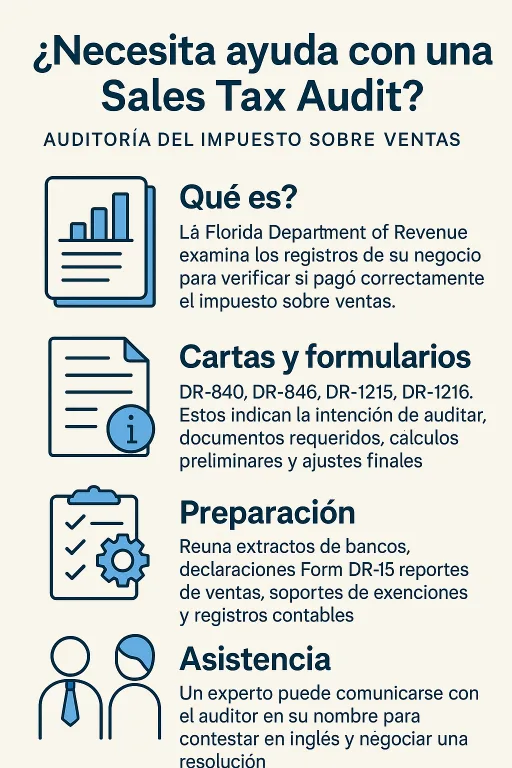

First Contact: The Audit Notices and What They Mean

Payroll audits in Florida typically begin with a letter. The document won’t always look alarming at first glance, but it establishes the audit period, lists requested documents, and sets deadlines.

Here’s what you should know about these notices:

- They are legally binding requests for information.

- They often ask for several years of records, not just the most recent filings.

- Ignoring or delaying your response will almost always escalate penalties and interest.

In Miami, I’ve seen small businesses get letters after routine filing discrepancies, only to find themselves facing a full-blown multi-year audit.

What Auditors Expect You to Provide

The Florida DOR will request a comprehensive package of employer records. While every case differs, common items include:

- Quarterly payroll filings and reemployment tax reports

- Employee wage detail reports

- Worker classification documents and contracts

- Payroll processor reports

- Bank statements showing payroll disbursements

- Copies of W-2s, 1099s, and any adjustments

Think of it this way: the auditor wants to tie every dollar of wages paid to a filing, a return, and a tax contribution. If there’s any gap, they’ll assume underpayment.

When the Books Don’t Add Up

Not every business keeps pristine records. Many of the Miami companies I’ve represented were relying on outdated QuickBooks setups, inconsistent spreadsheets, or bookkeepers who didn’t reconcile accounts regularly.

This creates real risk. If your books are incomplete:

- Auditors may disregard your data altogether and estimate from bank deposits.

- Unclear payroll entries can be interpreted as “off the books” wages.

- Missing documentation weakens your defense and strengthens their case.

Part of my role as a CPA is rebuilding those records. Sometimes that means going back through years of bank statements to recreate payroll expenses. Other times it means reconciling third-party processor data with what was filed. It’s tedious, but without it, you’ll be at the mercy of state estimates.

How Florida DOR Reconstructs Payroll Without Your Help

If you fail to supply sufficient records, the Department of Revenue won’t just give up. Instead, they use indirect methods to approximate what they believe you should have paid:

- Bank Deposit Analysis: They total deposits and assume a percentage was wages.

- Industry Standards: They compare your payroll ratios to similar businesses in Miami.

- Extrapolation: They take one month of data and apply it across the audit period.

These methods nearly always result in inflated assessments. Once the DOR puts a number on paper, it’s up to you to prove otherwise—an uphill battle without organized records and professional representation.

Frequent Pitfalls for Miami Employers

Over the years, I’ve noticed several recurring challenges that Florida business owners run into during payroll audits:

- Misclassifying employees as independent contractors to avoid reemployment tax.

- Unreported cash wages, especially in restaurants, construction, and personal services.

- Inconsistent filings, where quarterly reports don’t match annual totals.

- Late or missing filings, which automatically stack penalties on top of assessments.

Each of these mistakes is costly. Misclassification, for example, not only triggers back taxes but also penalties and sometimes worker benefit disputes.

Why Going It Alone Is Risky

Many Miami business owners believe they can “just explain things” to the auditor. Unfortunately, that usually backfires. Here’s why:

- Auditors are trained to gather evidence that supports additional tax assessments, not to act as neutral advisors.

- Casual comments—like “we paid some workers in cash”—can be documented and used against you.

- Incomplete or inconsistent record submissions raise red flags instead of resolving concerns.

As a CPA, my job is to manage communications, present only the necessary documentation, and make sure your side of the story is backed with proof.

Strategies a CPA Uses to Defend Payroll Tax Audits

When I take on a Florida payroll audit, my approach is systematic:

- Reconstruction of Records: If your books are incomplete, I rebuild them using bank statements, payroll processor files, and outside confirmations.

- Classification Review: I carefully analyze whether workers were correctly designated as employees or contractors.

- Penalty Abatement: Many assessments carry steep penalties. With proper arguments, these can sometimes be reduced or eliminated.

- Credit Verification: I ensure the DOR applies all eligible credits to reduce your liability.

- Appeals and Hearings: If the state overreaches, I represent you in administrative appeals, ensuring deadlines and procedures are strictly observed.

This methodical defense often reduces assessments dramatically compared to what business owners first see in their audit letters.

Real-World Case Examples from Miami

To give you an idea of how these audits unfold, here are anonymized case examples from past clients:

- Construction Firm Misclassification: The company had paid several workers as 1099 contractors. The DOR reclassified them as employees, generating a large tax bill. By producing contracts, work logs, and industry-standard guidance, I negotiated a reduced adjustment that saved the client over $40,000.

- Restaurant with Missing Reports: A local eatery had filed irregularly and couldn’t produce proper payroll reconciliations. We rebuilt three years of payroll data using bank statements, POS system exports, and vendor records. The state’s initial $120,000 estimate was cut down to under $30,000.

These cases highlight why representation matters: what looks like a hopeless situation can often be managed with the right defense strategy.

Using State and Local Resources to Stay Compliant

Even if you aren’t under audit yet, Florida provides compliance resources worth knowing:

- The Florida Department of Revenue Reemployment Tax page explains obligations and filing processes.

- The Taxpayer Rights and Responsibilities guide details appeal procedures if you disagree with an assessment.

- Local Miami-Dade County sites provide information on business tax receipts and local licensing requirements, which can interact with state-level compliance.

Knowing where to find authoritative information keeps you ahead of problems and reduces the likelihood of future audits.

Closing: Protect Your Miami Business Before It’s Too Late

Payroll tax audits are not just about numbers on a spreadsheet—they can determine whether your business survives financial scrutiny. The Florida DOR has vast authority to assess taxes, levy penalties, and enforce collections.

As a CPA with more than 20 years of hands-on experience representing Florida businesses, I know the tactics auditors use and the defenses that work. If your Miami company has received a payroll tax audit notice, or if you suspect your records won’t hold up under review, now is the time to act.

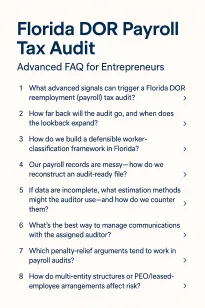

Florida DOR Payroll Tax Audit — Advanced FAQ for Entrepreneurs

Beyond late or missing filings, triggers include cross-system mismatches between quarterly wage reports and payroll-processor totals, inconsistent headcount-to-revenue ratios, contractor payments outside sector norms, statistical anomaly sweeps in targeted industries, third-party tips, abrupt experience-rate shifts after reorganizations, cross-agency leads (workers’ comp, licensing, new-hire reporting), and anomalies in intercompany labor sharing or officer compensation. See Florida DOR — Reemployment Tax Overview and What to Expect from a Florida Tax Audit.

Ordinarily up to three years of quarters. The period can expand with substantial underreporting, fraud indicators, repeated non-filing, non-cooperation, or prior adjustments suggesting broader issues. For process expectations, review Florida DOR — Audit Information and the Taxpayers’ Rights Advocate.

Adopt a documented, repeatable test weighing behavioral control, financial control, and the relationship’s nature (tenure, benefits, exclusivity). Align agreements with actual practice; verify contractor independence (EIN, license, insurance); re-evaluate after role or compensation changes; and for PEO/leased employees, confirm employer-of-record mechanics and rate usage. Start with Employees vs. Independent Contractors and supplement with U.S. DOL misclassification and IRS Pub. 15.

Rebuild from bank statements (identify cycles; isolate net pay and tax remittances), payroll-processor exports (gross-to-net detail; quarter summaries), and payment confirmations. Cross-walk W-2/1099 totals to the GL and quarterly reports; reconcile exceptions line-by-line; corroborate gaps with contemporaneous third-party evidence (timecards, job tickets). Core record expectations are outlined in Employer Guide to Reemployment Tax (RT-800002); W-2 filing logistics via SSA BSO.

Common approaches: bank-deposit analysis, headcount-to-revenue ratios, statistical sampling with extrapolation, and sector benchmarks. Counter with a superior reconstruction (documented assumptions; tie-outs), challenge sample design (strata, outliers, seasonality), document non-payroll deposits (owner contributions, loans, intercompany transfers), and provide defensible alternative computations with full workpapers. See Florida DOR — Audit Information.

Centralize contact through a single CPA representative; respond in writing mapped to the request list; avoid speculation; and request early disclosure of any sampling/extrapolation methodology. If disputes arise, use Informal Dispute Resolution and consult Taxpayer Rights & Responsibilities.

Evidence-backed reasonable-cause narratives—documented reliance on qualified advisors, declared emergencies, sudden loss of key finance staff, or systemic payroll-processor outages—paired with remedial controls (process upgrades, training) and proof of sustained compliance. Reference Taxpayer Rights and federal framing in IRS Pub. 15.

They blur employer-of-record determinations and tax-rate application. Maintain executed agreements; invoices that separate wages, taxes, and fees; FEIN alignment between filings and cash flows; and consistent GL treatment. Review Florida’s status guidance (Employees vs Contractors) and rate information (Reemployment Tax Rate).

Use a read-only portal with standardized folders (01_Engagement, 02_Entity_Chart, 03_Payroll_Processor, 04_Quarterly_Filings, 05_W2_1099, 06_Bank, 07_GL_Recs, 08_IC_Files, 09_Prior_Audits, 10_Policies_Controls). Provide PDFs and native files; enforce naming conventions (e.g., YYYY-Q#_Category_Description_v1.pdf); and maintain an index mapping each upload to the auditor’s request. For returns and payments, see Report & Pay Reemployment Tax and SSA filing via BSO.

Appeal when sampling or extrapolation methods are flawed, superior evidence is dismissed, or penalties ignore reasonable cause. Include a procedural timeline, point-by-point rebuttal, reconstructed schedules with citations to source, expert declarations where appropriate, and a proposed corrected assessment. Utilize Informal Dispute Resolution and consider the Taxpayers’ Rights Advocate.