Florida DOR Payroll Tax Audit Help in Miami-Dade and Broward County

Florida DOR Payroll Tax Audit Help in Miami-Dade and Broward County

If you’ve opened your mail and found a letter from the Florida Department of Revenue (DOR) announcing a payroll tax audit, chances are your stomach dropped. That single piece of paper means weeks of stress, endless requests for records, and the looming fear of thousands of dollars in taxes, penalties, and interest. For business owners in Miami-Dade and Broward County, these audits are not unusual. In fact, our region—Miami, Doral, Hialeah, Boca Raton, Fort Lauderdale, Hollywood, Coral Gables, Kendall, and beyond—is one of the busiest zones for payroll compliance enforcement in Florida.

I’m a CPA who lives and works right here. I’ve helped restaurants on Calle Ocho in Miami prove they weren’t hiding tipped wages, family-owned shops in Hialeah survive audits that threatened to bankrupt them, and Boca Raton professional service firms that misclassified part-time workers. Sometimes the work is neat and digital: clients upload QuickBooks backups and payroll summaries through a secure portal. Other times, I’m literally digging through dusty banker boxes at a construction yard or back office. Either way, the goal is the same—protect your business, reduce your liability, and keep the auditors from taking more than they should.

Why the Florida DOR Launches Payroll Tax Audits

Payroll tax audits are not random harassment. The Florida DOR has a clear mission: to make sure every employer is properly reporting and paying reemployment tax. If the state thinks you’ve been underreporting or misclassifying, you become a target. For South Florida businesses, the most common triggers include missing RT-6 filings, mismatches between IRS and Florida payroll numbers, or frequent use of 1099 contractors. Construction crews in Doral, restaurants in Hollywood, cleaning companies in Fort Lauderdale—these industries are practically magnets for DOR auditors.

Here’s an example: a Hialeah mechanic shop reported paying several helpers as independent contractors. The DOR discovered that those workers were using the shop’s tools, working regular hours, and taking instructions directly from the owner. That looked like an employee relationship, not independent contracting. The reclassification meant thousands in back payroll tax plus penalties. In another case, a small café in Coral Gables missed filing quarterly RT-6 forms for almost two years because their bookkeeper quit. The state assumed the worst, and the initial assessment was nearly $60,000 before we intervened and proved actual liability was much less.

Bottom line: the DOR uses data matching, industry profiling, and even anonymous tips to flag businesses. If you’re in Miami-Dade or Broward, chances are high your industry has already been singled out as “at risk.”

What Happens in a Payroll Tax Audit

The audit process starts with a letter. That letter outlines the tax periods under review and lists the records you must produce. It’s not optional—you’re legally required to respond. Typically, the auditor will want to see:

- Florida RT-6 returns for the quarters under review

- IRS payroll filings (941s, 940s)

- W-2s, 1099s, and year-end summaries

- Bank statements and canceled checks

- Payroll registers, ledgers, or software reports

Once they have your documents, auditors dig in. They cross-check amounts, look for discrepancies between contractors and employees, and test your internal controls. If you paid ten workers but only reported five, they’ll find it. If your 941 doesn’t match what you told Florida, they’ll find that too. For one Fort Lauderdale trucking business I represented, the auditor built a case based on nothing more than check stubs written to drivers. Because the drivers worked full-time and didn’t provide their own trucks, the state insisted they were employees. That assessment alone was over $100,000.

The audit often includes interviews. Auditors may ask pointed questions such as, “Do your contractors have other clients?” or “Who sets their schedule?” It’s easy for a casual answer to become damaging evidence. That’s why my role is to manage communication, prepare responses in advance, and limit exposure. You don’t want to be explaining payroll policies in the heat of the moment without someone who understands how the DOR thinks.

The IRS Connection: Trust Fund Recovery Penalty

One of the biggest misconceptions is thinking payroll problems are “just a state issue.” In reality, state audits often lead to federal ones. The IRS doesn’t need much encouragement to open its own case once Florida finds inconsistencies. And when the IRS steps in, the Trust Fund Recovery Penalty (TFRP) becomes the biggest threat.

The TFRP allows the IRS to pierce the business veil and go after owners, officers, or anyone with check-signing authority personally. It’s not limited liability anymore—they can take your bank accounts, garnish wages, or file liens against your house. For example, a restaurant in Boca Raton fell behind on making federal payroll deposits when cash flow tightened. The owner thought it would be a temporary issue. By the time the IRS got involved, the unpaid trust fund portion was over $80,000. They went after the owner personally. My job was to negotiate an installment agreement and prevent aggressive collection tactics.

That’s why taking a DOR audit seriously is critical. It’s not just the state you need to worry about. Every missed filing or misclassified worker is another breadcrumb leading the IRS straight to your door. A state notice today could become a federal levy tomorrow.

Why Miami-Dade and Broward Are Targeted

South Florida is unique. The diversity of industries, high number of immigrant-owned businesses, and prevalence of cash transactions create fertile ground for payroll issues. The DOR knows this. Miami-Dade and Broward are top enforcement zones because:

- Hialeah: Family shops often rely on handshake deals instead of formal payroll records.

- Doral: Rapidly growing companies juggling international clients and high staff turnover.

- Miami: Global workforce, lots of part-time gigs, and frequent contractor misclassification.

- Boca Raton and Fort Lauderdale: Professional firms and seasonal employers with fluctuating headcounts.

- Hollywood, Coral Gables, Kendall: Restaurants, construction crews, and cleaning companies with high-risk cash wages.

Each of these local factors creates fertile ground for audits. I’ve had construction crews in Kendall audited after paying subcontractors cash. I’ve had Fort Lauderdale law firms flagged because they misreported paralegals as contractors. I’ve had Miami restaurants targeted after a disgruntled waiter filed for unemployment benefits and the state discovered he was never listed as an employee. If it can happen to your neighbor, it can happen to you.

Common Mistakes That Make Audits Worse

The audit notice itself isn’t the worst part—it’s the mistakes business owners make after receiving it. I see the same errors over and over in Miami-Dade and Broward:

- Ignoring the letter. Hoping it goes away guarantees penalties and liens.

- Handing over messy records. Auditors assume the worst if numbers don’t line up.

- Talking too much. Off-hand comments like “we were short on cash” become evidence of intent.

- Not calling for help. Trying to explain yourself without representation almost always leads to higher assessments.

One Fort Lauderdale construction owner told the auditor that his contractors “worked for him every day.” That single phrase cost him thousands in reclassified wages. In contrast, another client in Coral Gables had me prepare written responses and organize payroll ledgers neatly—her penalties were cut in half. Presentation matters, and strategic silence matters even more.

How I Help as a CPA in Miami-Dade and Broward

When I take on a payroll audit case, I treat it like a defense strategy. Every word, every number, every document is weighed before it reaches the auditor. My process includes:

- Explaining the notice and translating the legal jargon into plain language.

- Organizing records so auditors see clarity, not chaos.

- Managing all communication so you don’t have to sit in stressful interviews.

- Challenging reclassification with evidence—contracts, invoices, proof of independence.

- Negotiating to reduce penalties and interest, often saving clients tens of thousands.

- Coordinating with the IRS if federal payroll issues surface.

For tech-savvy business owners, everything happens by email and secure portals. I’ve had Boca Raton firms upload PDFs on Monday and have me negotiate with the DOR by Friday. For others, it’s hands-on. I’ve sat in back rooms in Hialeah sorting paper receipts by year. I’ve hauled boxes out of Kendall warehouses to rebuild payroll records from scratch. Whatever your situation—digital or dusty—I adapt to it. The goal is the same: control the audit, protect your business, and keep your personal assets safe.

What You Should Do Right Now

If you’ve just received a DOR payroll tax notice, here’s your immediate action plan:

- Read the notice carefully. Mark deadlines on your calendar.

- Start collecting records. Even partial data helps me start building a defense.

- Do not contact the auditor directly. Anything you say can and will be used against you.

- Call a CPA. Having representation at the earliest stage saves money and stress.

- Stay current going forward. Filing and paying on time now shows good faith, even if prior years are under dispute.

I can’t stress enough: timing is everything. The earlier you involve professional help, the more options we have. Whether you’re in Miami, Doral, Hialeah, Boca Raton, Fort Lauderdale, or Hollywood, a payroll audit doesn’t have to destroy your business. But waiting too long to act almost always makes things worse.

Helpful .gov Resources

- Florida DOR – Reemployment (Payroll) Tax

- Florida Department of Revenue – Business Taxes

- IRS – Trust Fund Recovery Penalty

- IRS – Employment Taxes

- IRS – Payment Options

Closing Thoughts

Running a business in South Florida is tough enough without the DOR or IRS breathing down your neck. If you’re in Miami, Doral, Hialeah, Boca Raton, Fort Lauderdale, Hollywood, Coral Gables, or Kendall and facing a payroll tax audit, you don’t have to go it alone. I’ve helped neighbors across Miami-Dade and Broward dig out from under audits that looked hopeless. Some cases were neat and digital, others were messy and paper-based. In every case, the outcome was better because the client didn’t face the auditor alone.

Whether you’re tech-savvy and organized or still working out of banker boxes, I can adapt to your situation. My offices are available throughout the region, and I’m willing to meet you at your business if that’s easier. Most cases, however, can be handled efficiently online—saving you time and stress. Whatever your preference, the key is acting now. The sooner we talk, the more control we have over the outcome. Reach out today and let’s protect your business together.

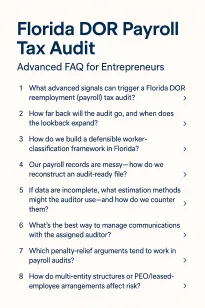

Advanced FAQs — Florida DOR Payroll Tax Audits (Miami-Dade & Broward)

Florida DOR routinely uses data matches and risk models to flag employers in Miami-Dade and Broward. Advanced signals include: (1) mismatches between IRS Forms 941/940 and Florida RT-6 totals; (2) spikes in 1099-NEC payments to individuals that look like wages; (3) unemployment claims from workers you reported as contractors; (4) industry profiling (restaurants, construction, cleaning, hospitality); (5) new-hire reports that don’t align with your RT-6 filings; (6) repeated address or FEIN changes; and (7) prior audit history. Expect auditors to pull bank statements and POS summaries to reconcile deposits against reported payroll.

Gov resources: Florida DOR — Reemployment (Payroll) Tax • IRS — Employment Taxes

Florida applies a common-law control framework: who directs how, when, and where the work is done? A 1099 form or a “contractor agreement” is not decisive if day-to-day control looks like employment. Evidence that helps show true independence includes: multiple active clients, business insurance, separate business entity, advertising, own tools/equipment, ability to hire helpers, and payment by project (not hourly). In audits, auditors test reality over paperwork; aligning actual practices with your contracts is critical.

Gov resources: IRS — Independent Contractor (Common-Law) • Florida DOR — Reemployment Tax

In a routine case with timely filed returns, audits commonly examine several prior years. If returns are missing, materially incorrect, or there’s suspected intent to evade, the look-back can expand and include more periods. Practically, exam scope also grows when the auditor finds systemic issues (e.g., widespread contractor misclassification). A strong file (complete RT-6s, reconciled payroll registers, clean 941/940 ties) helps keep the window narrow; messy or missing records tend to widen it.

Gov resources: Florida DOR — Business Taxes

Auditors triangulate: bank deposits analysis, POS summaries, vendor bills, and headcount interviews to impute labor costs. If cash withdrawals line up with busy periods and there’s no recorded payroll, they may assume under-reported wages. To counter, we document non-payroll cash uses (owner draws, petty cash with receipts, cash purchases), reconcile POS to bank (merchant fees, chargebacks, tips), and use credible logs or affidavits to explain anomalies. The goal is to break the chain of assumptions that inflate “phantom” wages.

Gov resources: IRS ATG — Cash-Intensive Businesses

Using a payroll provider or an employee-leasing/PEO arrangement helps—but doesn’t make you bulletproof. If filings or tax deposits were done under the wrong FEIN, workers weren’t properly onboarded, or some wages were paid off-cycle/outside the platform (cash, Zelle®, checks), Florida can still assess the client employer. Maintain the leasing agreement, proof of Florida reemployment filings under the leasing FEIN, and reconciliation schedules tying platform reports to your GL and bank. For federal issues, CPEO status can matter; at the state level, documentation and alignment matter most.

Gov resources: IRS — CPEO • Florida DOR — Reemployment Tax

Digital trails help auditors. Regular, payroll-like transfers (weekly/bi-weekly, same amounts, during business hours) to individuals who work on your premises look like wages. If those payees don’t issue invoices, have no EIN, and work under your supervision, expect scrutiny. If you truly have contractors, build an evidence file: W-9 + EIN, certificate of insurance, invoice + SOW, proof of multiple clients, and clear deliverables. Treat ad-hoc payments like you would approve vendor bills—paper the file before you pay.

Gov resources: IRS — Independent Contractor

Push for a representative sample. Seasonal businesses (beachfront restaurants, event contractors) shouldn’t be judged by peak quarters alone. Provide calendars, job logs, and revenue seasonality to justify a different sample frame or stratified sampling. If the projection uses flawed inputs (e.g., treats reimbursed expenses as wages), attack the assumptions with documentation and alternative computations. The playbook: make the sample smaller, cleaner, and more representative—then constrain the projection window.

Gov resources: IRS — Audits (General)

If Florida finds material under-withholding or unreported wages, the IRS may review your federal deposits. If federal payroll taxes (especially the withheld “trust fund” portion) weren’t remitted, the IRS can assess TFRP against any responsible and willful person—owners, officers, controllers, sometimes managers with check authority. Prepare by centralizing federal deposit proof (EFTPS), board minutes, duty descriptions, bank authority lists, and documenting who actually decided which bills to pay during cash crunches. If invited to a Form 4180 interview, prep with counsel first.

Gov resources: IRS — Trust Fund Recovery Penalty

Expect additions for late filing, late payment, and underreporting, plus interest. While Florida doesn’t mirror the IRS “first-time abate,” the Department may consider reasonable cause: documented bookkeeper turnover, medical emergencies, natural disasters, or demonstrable reliance on bad professional advice—backed by records. We also mitigate by correcting errors quickly, filing missing returns, and showing improved controls. If liability remains, we can explore installment arrangements and—when appropriate—administrative review to challenge parts of the assessment.

Gov resources: Florida DOR — Business Taxes

Start with a targeted rebuttal, not a broad denial. Build a worker-by-worker matrix showing independence factors (entity/EIN, COI, multiple clients, tools, price control, substitution rights). Provide contracts, invoices, and proof of project-based work. Where classification is weak, negotiate scope—remove edge cases, limit quarters, or adjust rates. Preserve appeal rights and deadlines in writing. If needed, elevate to administrative review with a concise issues list and cleaned exhibits; messy packages lose good arguments.

Gov resources: Florida DOR — Business Taxes

State assessments target the liable employing entity, but sloppy intercompany practices (shared payroll, commingled accounts, paying wages from the “wrong” entity) can invite alter-ego theories or joint liability arguments. Federally, TFRP is a personal assessment—entity walls don’t protect “responsible, willful” persons who controlled payments when payroll deposits were skipped. Keep clean separations: distinct payroll accounts, formal intercompany agreements, and documented decision rights.

Gov resources: IRS — TFRP

Institutionalize controls: (1) centralize payroll through one vetted platform; (2) lock a monthly reconciliation—941/940 ↔ RT-6 ↔ GL ↔ bank; (3) enforce a contractor onboarding packet (W-9 + EIN, COI, SOW, multi-client attestation, invoice policy); (4) separate duties (one person inputs time, another releases payroll); (5) pre-audit each quarter—tie headcount to job schedules and POS; (6) formal tip reporting (if applicable); (7) written records policy (7+ years for payroll). Make a single leader accountable and review quarterly with your CPA.

Gov resources: IRS — Employment Taxes • Florida DOR — Reemployment Tax