CP40 Notice: “Why Did the IRS Send Me to a Debt Collector?”

Introduction: The Shock of CP40

“I got this CP40 notice from the IRS — is this even real? Do I now have a debt collector calling me about taxes? Will this wreck my credit?”

This is exactly how taxpayers describe the moment on Reddit when CP40 shows up in the mailbox (Reddit example). The confusion is real, and the anxiety is justified.

As someone who has represented taxpayers before both the IRS and state revenue departments for over 20 years, I can tell you: CP40 doesn’t mean game over. But it does mean the IRS has escalated your case, and you now face professional debt collectors.

What the CP40 Letter Actually Means

The CP40 notice is the IRS’s way of telling you your tax debt has been sent to a private collection agency (PCA).

According to IRS.gov: “The IRS will notify you in writing that your account is being transferred to a private collection agency.”

The IRS currently works with four contractors:

- CBE Group

- ConServe

- Performant

- Pioneer

If the agency contacting you is not on this list, that’s a red flag for a scam.

This outsourcing move has been controversial. TIGTA (Treasury Inspector General for Tax Administration) has published reports noting risks of abuse, consumer complaints, and lack of oversight when the IRS shifts debts to private hands. Taxpayer forums, particularly Reddit, are full of confusion about whether CP40 means the debt is now “in collections” in the same way as a credit card bill — the answer is no, but the aggressive phone calls can feel identical.

Where CP40 Fits in the IRS Collection Timeline

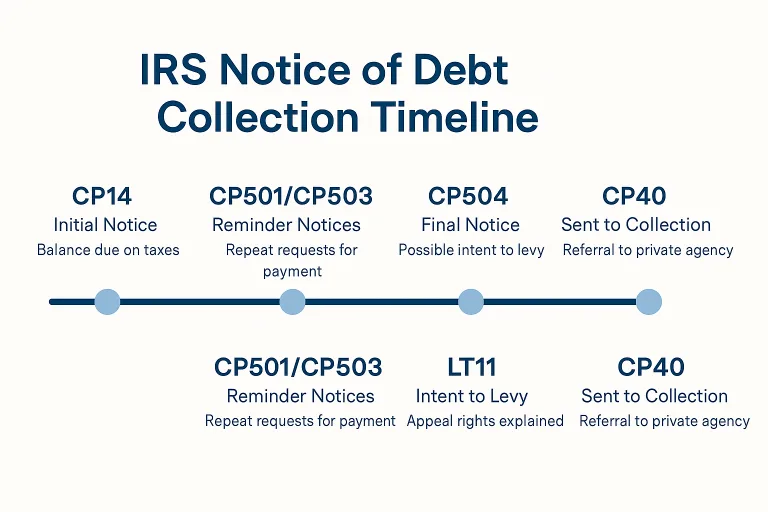

Understanding where CP40 sits in the sequence of IRS notices is critical. Here’s the typical order:

- CP14 – First balance due notice.

- CP501 and CP503 – Reminder notices.

- CP504 – Final notice before levy action.

- LT11 / Letter 1058 – Formal Intent to Levy, including right to appeal.

- CP40 – Debt transferred to a private collection agency.

IRS collection notices escalate from CP14 to CP40, when your case is assigned to a private debt collector.

Each stage represents an escalation. By the time CP40 arrives, the IRS has effectively outsourced the “chasing” of your balance, but the debt remains with the federal government. The collector does not own the debt — they are merely a contractor.

Common Misconceptions Seen on Reddit

In CP40 threads, taxpayers often ask:

- “Does this hurt my credit report?”

No. As one Reddit user confirmed: “The IRS does not report normal tax debt to credit bureaus.” - “Can I still just pay the IRS directly?”

Yes. You can always bypass the collector and pay IRS directly. Many tax professionals advise this, since it reduces confusion. - “Is CP40 a scam letter?”

Real CP40 letters come by mail, name one of the four agencies, and direct you to IRS payment portals. Anything else — especially phone calls demanding gift cards, or letters with USB drives enclosed — is fraudulent. IRS scam alerts warn taxpayers constantly about these tactics.

DIY Steps (and Why They Fall Short)

DIY checklists are easy to find:

- Confirm the PCA’s name matches the IRS list.

- Verify your balance using your IRS Online Account.

- Pay IRS directly, or work with the PCA to set up a plan.

But this is where reality diverges from IRS brochures. On Reddit, DIYers describe:

- Conflicting balances between the PCA and IRS online account.

- Aggressive calls pressuring them to commit to payment amounts they can’t afford.

- Endless hold times trying to reach the IRS directly for clarification.

Without deeper access to IRS data, you are playing blindfolded. You see the bill, but not the hidden coding that drives it.

The Professional Edge: What Edward Parsons, CPA, Brings to a CP40 Case

When you bring in a CPA who focuses on IRS controversy work, the game changes.

Here’s what I can do that you cannot DIY:

- Access IRS transcripts beyond your reach. Entity transcripts, master file records, and transmod data reveal misapplied payments, duplicate assessments, or incorrect penalties.

- Interpret transaction codes. A sudden $2,000 jump may be TC 290 additional tax or TC 570 hold. Collectors will never explain this — I can.

- Escalate past the PCA. I deal directly with IRS revenue officers, appeals officers, and collections units. The PCA is a middleman — I can take them out of the loop.

- Invoke representation rights. Once I’m your CPA, the calls stop. The IRS and PCA are legally required to talk to me, not you.

- Identify hidden relief. Collectors won’t suggest Offers in Compromise, Currently Not Collectible status, or penalty abatements. I evaluate every option.

- Experience. With 20+ years handling IRS disputes, from Fortune 50 audits to small business payroll tax fights, I know the IRS’s playbook.

This is why discerning taxpayers — those who want solutions, not phone harassment — bring in a professional.

Escalation Risks of Ignoring CP40

What happens if you throw CP40 in the trash?

- Calls and letters escalate.

- Interest and penalties continue.

- The IRS can pull the case back, issue liens, or levy wages and bank accounts.

Redditors sum it up best: “The calls don’t stop, and it only gets worse if you ignore them.”

Continuous Collection Pressure

The most immediate risk is the ongoing harassment from the private collection agency. These agencies are contracted to pursue your debt persistently. Ignoring CP40 means bracing yourself for repeated phone calls, letters, and attempts to reach you at home or work. While they are not allowed to threaten or harass beyond the boundaries of the Fair Debt Collection Practices Act, many taxpayers describe the experience as relentless. Over time, the psychological stress of constant calls can become as damaging as the financial debt itself.

Accruing Interest and Penalties

Tax debt is not static. Even when assigned to a private collector, the IRS continues to add daily interest and penalties. This means that a debt of $5,000 today could balloon to $6,000 or $7,000 over the course of a year simply by inaction. The IRS interest rate compounds daily, and late-payment penalties can reach 25% of the original tax owed. Ignoring CP40 doesn’t freeze your liability; it silently magnifies it.

Return to IRS Enforcement

Perhaps the most dangerous consequence of ignoring CP40 is that your case can be pulled back from the private collection agency and reassigned directly to IRS enforcement. Once that happens, the IRS has the power to take actions the private agency cannot: filing federal tax liens, levying bank accounts, garnishing wages, and even seizing property. Many taxpayers mistakenly believe that because their debt is “with collections” it is somehow less serious. In reality, ignoring CP40 can push you back into the direct sights of the IRS itself, where consequences are harsher and more immediate.

Damage to Financial Stability

Even though IRS debts are not reported to credit bureaus in the same way as consumer loans, liens that arise from ignored debt are a matter of public record. A federal tax lien can appear in background checks, loan underwriting, and professional licensing reviews. For business owners, liens can disrupt vendor relationships and financing options. For individuals, a lien can complicate mortgage applications and refinancing. Ignoring CP40 makes these outcomes far more likely.

Loss of Negotiation Leverage

Timing is critical in tax resolution. By ignoring CP40, you lose the chance to negotiate favorable terms early. Installment agreements, penalty abatements, and even settlement options like an Offer in Compromise are easier to pursue when you engage proactively. Waiting until enforcement escalates not only increases your balance but reduces the IRS’s willingness to negotiate lenient terms. In practical terms, the longer you delay, the fewer tools remain on the table.

Emotional and Practical Costs

Finally, there is the human cost. Taxpayers who ignore CP40 often describe feeling trapped, embarrassed, and unable to plan for the future. Financial uncertainty bleeds into daily life — relationships, work, and health. The stress of knowing the IRS is lurking, combined with the unpredictability of collection calls, creates a constant background of anxiety that makes it harder to focus on solutions.

Case Studies

Case Study 1: The Individual Taxpayer in Panic Mode

Reddit is full of posts like “I got this CP40 in the mail today — is this even real? Am I about to get my wages garnished?” (example thread).

One taxpayer I worked with had nearly the exact experience. They owed around $14,000 across two years of unfiled returns. When the CP40 showed up, the panic set in. The private collection agency started calling daily, and the taxpayer was on the verge of agreeing to send $500 a month — far more than they could afford.

Here’s where a CPA approach changed everything:

- I pulled their IRS account and transmod transcripts. What showed up immediately was a misapplied $5,000 payment from a prior year. The PCA didn’t have this data. They were chasing the wrong balance.

- Once corrected, the real liability dropped to just under $9,000.

- With full documentation, I went back to the IRS (not the collector) and secured a streamlined installment agreement at $225/month.

The taxpayer’s reaction? Relief. They went from “I thought they were going to freeze my bank account” to “I can actually afford this, and the calls have stopped.” It’s exactly what people on Reddit mean when they say: “The IRS doesn’t care what you can pay, they just want something. A pro knows how to negotiate it.”

Case Study 2: The Small Business Owner Buried in Letters

Small business owners often get hit harder. One r/smallbusiness user wrote: “IRS sent me a CP40 about old payroll taxes. Collector is saying I owe $60k. I don’t even know where to start.” That confusion is common — payroll tax debt snowballs quickly with penalties.

One of my business clients was in almost the same position. They had received multiple CP40 letters across different tax periods, totaling $60,000 according to the collector. The PCA was aggressive, calling not just the owner but also the office line, which embarrassed the staff.

Here’s how I handled it:

- I pulled entity transcripts across all quarters. These revealed that penalties were stacked incorrectly — failure-to-deposit penalties had been calculated multiple times.

- After a penalty abatement request with supporting financials, the balance was reduced by $20,000.

- Rather than let the PCA dictate terms, I worked directly with the IRS Collections unit to structure a phased payment plan. Payments were tied to the business’s actual cash flow, not a one-size-fits-all demand.

On Reddit, you’ll often see comments like: “The IRS doesn’t care if you’re a business — pay up or else.” That’s only half true. The IRS will work with you, but only if you know how to present financials in the right format. A CPA can package this properly; a private collector won’t even bring it up.

The business owner later told me: “Before, every call felt like I was about to lose the company. Now it feels like we have breathing room to rebuild.” That’s the difference between reacting to CP40 and strategically addressing it.

Case Study 3: The Expat Who “Already Paid”

One of the more complicated CP40 cases came from an expat living in Spain. They received a CP40 letter for $12,000, but swore they had already wired money to the IRS the year before. In fact, they even had a SWIFT confirmation from their bank.

This is exactly the kind of situation that shows up on r/IRS or r/taxpros: “Why is the IRS saying I owe when I already paid? Do I just send proof to the collector?” (related discussion).

Here’s what happened when I got involved:

- I pulled their master file transcript and saw the payment was indeed received — but it was credited to the wrong tax year. The IRS had applied it to 2018 instead of 2019.

- The PCA had no visibility into this; they only saw “balance due 2019.”

- I filed a payment reallocation request with the IRS. Within six weeks, the balance was adjusted, and the CP40 was effectively nullified.

For the expat, the emotional toll was enormous. They were abroad, dealing with IRS letters that looked suspiciously scammy, and had no way to call toll-free numbers from Europe without paying huge phone charges. Reddit comments echo this: “I’m overseas, IRS letters scare the hell out of me. I can’t even call them easily.”

By intervening, I not only fixed the balance but also eliminated the need for any interaction with the PCA. For this taxpayer, CP40 was a false alarm — but without transcripts and representation, they could have wasted thousands by “double paying.”

Technical Deep Dive: IRS Transcripts

- Account Transcripts: Available online, basic.

- Entity Transcripts: Business-level records, only professionals can access.

- Transmod Transcripts: Detailed module-by-module history, showing coding like TC 420 (exam referral), TC 480 (OIC pending), or TC 582 (lien filed).

Collectors don’t explain these. But they’re the roadmap to resolving IRS disputes.

Technical Deep Dive: IRS Transcripts

When a CP40 notice arrives, the private collection agency has only limited information: the amount they claim is due, the tax year, and basic contact details. What they don’t have are the full internal IRS records that explain how that balance was calculated. This is where IRS transcripts come into play, and why they are essential for anyone facing collections.

Account Transcripts – The Starting Point

Account Transcripts are the most accessible records. Taxpayers can pull them through their IRS Online Account. These transcripts show a summary of return filings, assessments, and payments by year. For example, they will display the original tax assessed, penalties applied, and any payments credited.

But here’s the limitation: Account Transcripts don’t tell the whole story. They won’t reveal why a payment was delayed, when a penalty was assessed, or whether a freeze code is blocking an adjustment. For taxpayers holding a CP40, this limited view often raises more questions than it answers.

Entity Transcripts – The Business Perspective

Entity Transcripts apply to businesses — corporations, partnerships, and sole proprietorships with payroll or excise obligations. They capture information across multiple tax modules, which is crucial when a CP40 relates to unpaid payroll taxes.

For instance, if a business missed payroll deposits in several quarters, an Entity Transcript can reveal whether penalties were calculated correctly or duplicated. In one case I handled, an Entity Transcript showed that a penalty had been applied twice for the same missed deposit. Without that transcript, the business owner would have had no way of challenging a $15,000 error.

Transaction Module (Transmod) Transcripts – The Forensic Tool

The real power lies in Transaction Module, or “transmod,” transcripts. These are not available online to taxpayers; they must be pulled by a professional authorized under IRS Circular 230, such as a CPA.

Transmod transcripts display every coded entry the IRS made on an account, line by line. Examples include:

- TC 150 – Original return filed.

- TC 290 – Additional tax assessment.

- TC 570 – Hold on account pending further review.

- TC 582 – Notice of Federal Tax Lien filed.

- TC 971/AC 043 – Account referred to a private collection agency.

For a CP40 case, this level of detail is invaluable. If the PCA says you owe $12,000 but the transmod shows a misapplied payment or duplicate penalty, you have evidence to challenge the balance directly with the IRS. Collectors can’t see these codes — but I can.

Why This Matters for CP40

Ignoring CP40 or trying to negotiate blindly with a private collector is like playing poker without seeing your cards. You are negotiating in the dark. By pulling and analyzing transcripts, a CPA illuminates the entire picture: what the IRS thinks you owe, why they think you owe it, and where they may have made mistakes.

For discerning taxpayers, especially those with larger balances or business liabilities, transcripts are not just paperwork — they are the roadmap to resolution. They turn a confusing CP40 notice into a solvable problem.

Policy & Oversight of Private Collection Agencies

The use of PCAs has been heavily criticized:

- TIGTA reports highlight taxpayer confusion, aggressive calls, and cases where PCAs pressured people into payments they could not afford.

- Advocacy groups argue CP40 disproportionately hits low-income taxpayers least able to defend themselves.

- Despite criticism, Congress has reauthorized private collection programs multiple times, citing revenue recovery.

For taxpayers, this means one thing: CP40 is not going away. You need to know how to respond intelligently.

Scam Warnings: CP40 vs. Fakes

Real CP40 letters:

- Arrive by U.S. mail.

- Name one of four IRS-approved PCAs.

- Never include USB drives, QR codes for payment, or third-party accounts.

Fake letters:

- Ask for payment to non-IRS accounts.

- Use threats of immediate arrest.

- Contain typos, generic greetings, or unusual enclosures.

Always cross-check with IRS scam alerts.

Conclusion: Control, Clarity, and Professional Backup

A CP40 notice is more than just another IRS letter — it’s a signal that your case has crossed into a new phase. While private collection agencies don’t have the same enforcement powers as the IRS itself, ignoring their letters and calls comes with real risks: growing penalties, mounting stress, and the possibility of your file being pulled back for direct IRS enforcement.

At the same time, CP40 is not the end of the line. It doesn’t mean your wages will be garnished tomorrow, and it doesn’t automatically damage your credit report. What it does mean is that you now face professional debt collectors whose only job is to keep you on the phone until you agree to pay, often without explaining your true rights or alternatives. This is where clarity makes all the difference.

By examining IRS transcripts, decoding transaction codes, and leveraging representation rights, a CPA can cut through the noise. You don’t have to rely on what a call-center agent tells you — you can see the IRS’s internal records, understand what the balance really is, and use legal pathways to negotiate terms that fit your situation. For business owners, expats, and individuals alike, this level of clarity can mean the difference between financial chaos and a manageable solution.

After more than twenty years representing clients in audits, collections, and high-stakes disputes, I’ve seen how much better outcomes are when taxpayers stop reacting to letters in fear and start acting with professional backup. The CP40 notice is not a dead end; it’s an opportunity to take control with the right guidance.