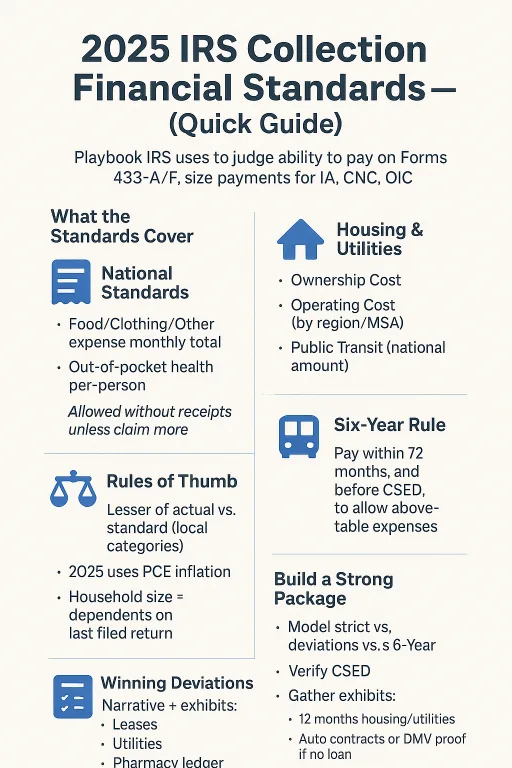

Everything You Need to Know About the IRS Collection Financial Standards (2025)

A practitioner’s guide to the 2025 IRS Collection Financial Standards—how the PCE update affects allowances, what counts under national vs. local rules, and when smart deviations stick. We cover housing, transportation, health care, the six-year rule, and Form 433 strategy. Need help modeling IA vs. CNC vs. OIC? Ed Parsons, CPA can review your numbers and package the exhibits.

Everything You Need to Know About the IRS Collection Financial Standards (2025) Read More »