Understanding a Complex Net Operating Loss Case

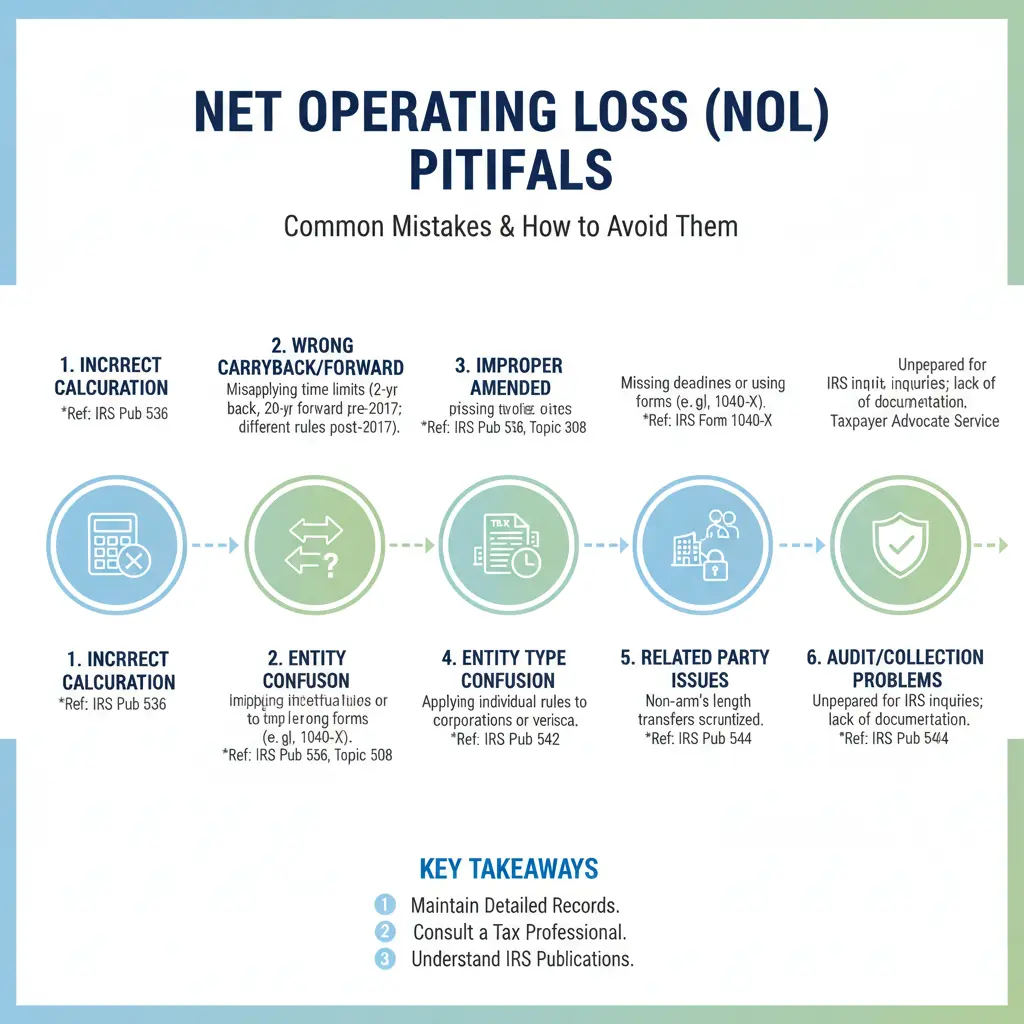

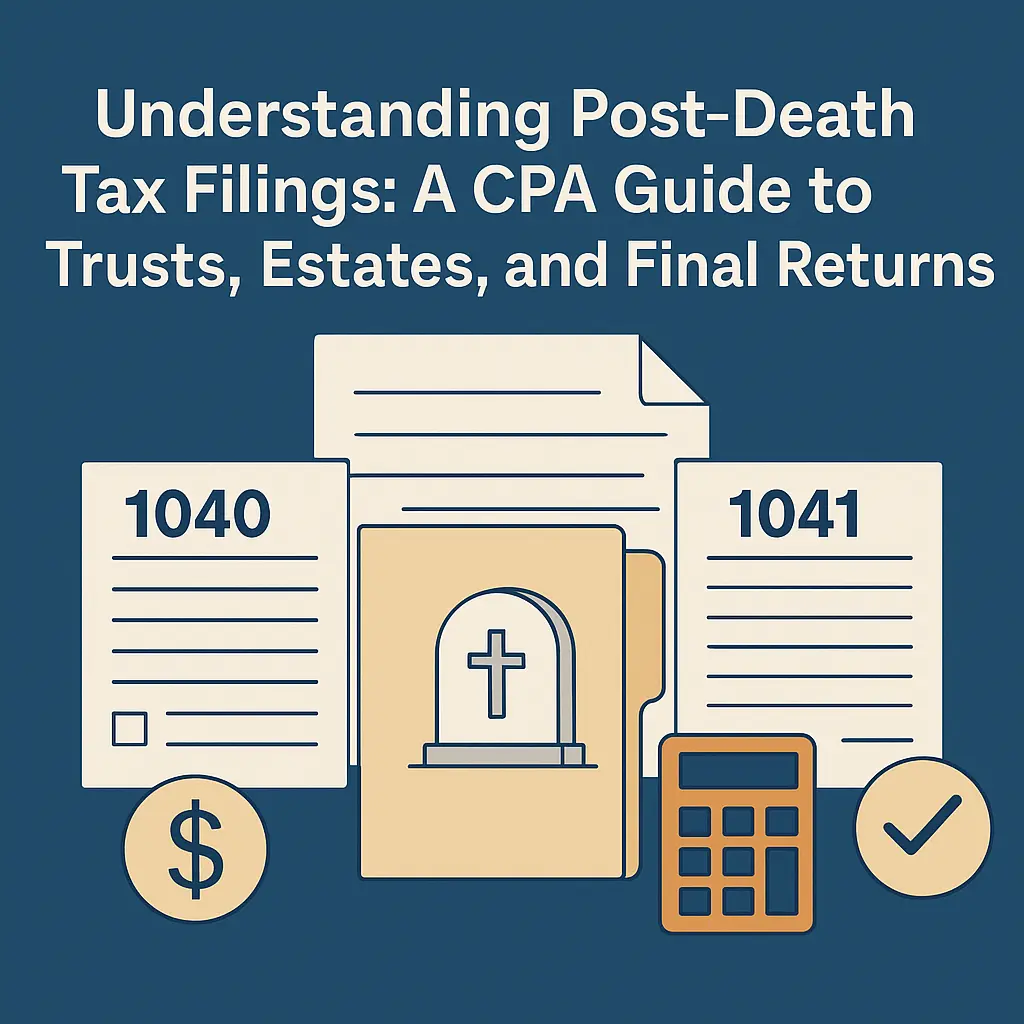

It’s common for family members to help when a parent or spouse faces IRS problems. But when an old net operating loss and related-party transactions are involved, “just filing an amended return” isn’t that simple. Here’s how Ed Parsons, CPA, unpacks these complex cases and builds a defensible path forward.

Understanding a Complex Net Operating Loss Case Read More »