IRS Tax Resolution Services in Hialeah, FL: CPA Guidance for Industrial, Commercial, and Food Businesses

Hialeah, FL is known as one of the most industrious cities in Miami-Dade County. With its busy warehouses, thriving food production facilities, and long-standing family-owned companies, the city embodies hard work and entrepreneurial spirit. Yet even the most successful business owners in Hialeah can find themselves on the receiving end of an IRS notice. These letters often arrive without explanation, leaving owners confused, fearful, and uncertain about the future. This is where IRS tax resolution services in Hialeah, FL and the support of a trusted CPA in Hialeah, FL can mean the difference between crisis and recovery.

Why Hialeah Businesses Face Unique IRS Challenges

Hialeah’s economy is built on commerce, industry, and food distribution. While this diversity provides opportunity, it also creates complex tax issues that frequently trigger IRS scrutiny. Common problems include:

- Payroll tax compliance: Businesses that fall behind on payroll deposits quickly accumulate penalties and face Trust Fund Recovery Penalties, which hold owners personally liable.

- Import/export documentation: Warehouses handling international goods must report transactions accurately. Errors or delays often lead to IRS inquiries.

- Food industry recordkeeping: Distributors and processors with thin margins struggle to maintain complete records, making them vulnerable to audits.

- 1099 mismatches: Contractors, drivers, and suppliers are often issued multiple 1099s, which can confuse IRS systems.

Cuando Llega una Carta del IRS

Muchos dueños de negocios en Hialeah reciben cartas como la CP2000 o la CP14 sin saber por qué. Estas cartas hablan de ingresos no reportados, impuestos atrasados, o errores en las declaraciones.

La primera reacción suele ser miedo — miedo de perder el negocio, de que congelen las cuentas bancarias, o de que se afecte el pasaporte para viajar al extranjero. En realidad, la mayoría de las cartas del IRS son propuestas de ajustes y no decisiones finales. Con la ayuda de un CPA en Hialeah, FL, usted puede responder correctamente y evitar que el problema crezca.

Case Study: A Hialeah Food Distributor Under Pressure

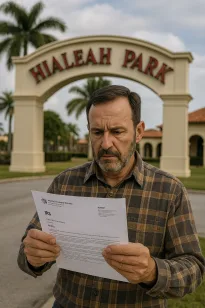

Consider the case of a food distribution company located in Hialeah’s industrial district. The owner, who had built the company from a single truck into a thriving warehouse operation, received an IRS notice claiming more than $250,000 in unpaid payroll taxes. The letter warned of possible levies and mentioned that unresolved balances could lead to passport restrictions. For a man who frequently traveled abroad to source products, the threat was devastating.

Case Study Expanded: How I Helped a Hialeah Distributor Protect His Business

When the owner of a food distribution company in Hialeah came to me with an IRS notice demanding more than $250,000 in payroll taxes, he was terrified. His letter suggested aggressive collection actions and even mentioned that his passport could be at risk if the balance remained unresolved. For someone who relied on international travel to secure contracts, this was a nightmare. Employees were already whispering about job cuts, and vendors were beginning to hold back. The stakes were high, and he needed answers fast.

The first thing I did was pull the company’s IRS transcripts. I always start here, because these records reveal how the IRS has logged every payment and adjustment. What I found was troubling. Several payroll tax payments had been applied to the wrong periods, creating the appearance of delinquency. Other deposits, which the client had proof of making, weren’t showing up at all in the IRS system. From the IRS’s perspective, it looked like the company had simply failed to pay, but I could see that the real issue was misapplication and missing credits.

From there, I built a detailed case. I gathered payroll ledgers, reconciled them with the company’s bank statements, and organized deposit slips. I worked with their payroll provider to retrieve electronic confirmations and traced the path of every single payment. Piece by piece, I created a package that showed exactly what had happened. The business had been paying — the IRS just wasn’t crediting those payments correctly.

I then prepared a comprehensive response for the IRS. This included cover letters explaining the discrepancies, spreadsheets that matched deposits to payroll cycles, and copies of supporting documents for every claim. Submitting that package was only the beginning. Over the following months, I negotiated directly with IRS agents. Each conversation required patience and persistence. At times, the IRS pushed back, but by consistently presenting the evidence, I was able to keep the case moving toward resolution.

Meanwhile, I made sure the owner understood each step. I reassured him that while the IRS letter was intimidating, the numbers didn’t reflect reality. I explained how the passport risk could be prevented if we stayed proactive. My job wasn’t just to fight the IRS; it was also to protect his peace of mind so he could keep leading his company without losing focus.

In the end, our work paid off. The IRS acknowledged that most of the liability stemmed from misapplied payments. The supposed $250,000 debt dropped by nearly 70%. For the remainder, I secured a structured installment agreement tailored to the company’s cash flow. This kept the business alive and allowed the owner to keep his passport. His employees kept their jobs, and vendors once again felt confident extending credit. What started as a terrifying crisis became a manageable challenge.

As a CPA in Hialeah, FL, these are the cases that remind me why I do this work. It’s not just about numbers — it’s about saving businesses, protecting families, and giving owners the confidence to keep building their future even when the IRS comes knocking.

The Audit Process in Hialeah

IRS audits can take several forms, and Hialeah businesses should know what to expect:

- Correspondence audits: Done by mail, usually for smaller issues such as mismatched 1099s or deductions.

- Office audits: Conducted at the Miami IRS office, often targeting businesses with complex revenue streams.

- Field audits: The most serious, where IRS agents visit your warehouse, office, or facility in person.

En cualquier tipo de auditoría, usted tiene el derecho de ser representado. Un CPA en Hialeah, FL puede hablar en su nombre, organizar la documentación, y proteger sus derechos como contribuyente.

IRS Resolution Options for Hialeah Businesses

When tax debt becomes overwhelming, business owners in Hialeah have several options:

- Installment agreements: Set up monthly payments to keep your business operating while resolving debt.

- Offer in Compromise: Settle for less than the total owed if you qualify under strict IRS guidelines.

- Penalty abatement: Reduce penalties if you can show reasonable cause, such as illness, natural disaster, or reliance on bad advice.

- Currently Not Collectible status: Stop IRS collection actions temporarily if your business demonstrates financial hardship.

- Audit reconsideration: Challenge an audit decision with new evidence or corrected records.

Practical Tips for Hialeah Business Owners

- Pull your transcripts: This is always step one. Without them, you don’t know what the IRS believes you owe.

- Document everything: Payroll, vendor payments, inventory logs — keep detailed records.

- Respond on time: Even a short delay can escalate the problem.

- Seek local guidance: Work with a CPA in Hialeah, FL who understands the IRS and the local business environment.

La Ventaja Local

Trabajar con un profesional en Hialeah significa trabajar con alguien que entiende el idioma, la cultura, y el tipo de negocios que hacen de esta ciudad un motor económico. Ya sea que maneje un almacén de ropa, una planta de producción de alimentos, o una empresa de transporte, usted necesita un aliado que sepa cómo navegar los procesos del IRS y defender sus intereses.

IRS tax resolution services in Hialeah, FL son más que un servicio — son una protección para su negocio, su familia, y su futuro.

FAQs for Hialeah Business Owners

Hialeah Tax Resolution — Personal & Business FAQs

Receiving a Notice of Intent to Levy is one of the most stressful experiences a taxpayer can face. This notice means the IRS is preparing to seize your wages, bank accounts, or other assets. If you live or work in Hialeah, the IRS collections unit in South Florida has authority to move quickly once you’ve ignored earlier notices. The worst thing you can do is wait.

With my 20+ years of experience as a CPA specializing in tax resolution, and after representing thousands of taxpayers, I know the exact steps to stop or release a levy. I can file for a Collection Due Process hearing, negotiate a payment plan, or prove hardship to classify you as “currently not collectible.” Many residents don’t realize that the IRS can take most of each paycheck until the debt is paid in full, leaving you with barely enough to survive.

Having a professional step in changes everything — it shows the IRS you’re serious and gives me the ability to negotiate directly with their revenue officers. I meet my clients in Hialeah at their business, home, or office to review tax documents and financials in person. My role is to protect your assets and give you breathing room while finding the best long-term resolution.

Yes, the IRS has authority to garnish wages directly from your employer without needing a court order. Once the notice is sent, your employer in Hialeah is legally required to comply. Wage garnishment can leave you with only a small exempt amount each pay period. The key to stopping it is speed.

In my 20 years of handling these cases, I’ve stopped wage garnishments in as little as 24–48 hours by filing emergency appeals or negotiating alternative resolutions. Thousands of South Florida clients have trusted me to present their financials to the IRS in a way that meets requirements but protects household cash flow.

Unlike generic resolution firms, I can meet you right in Hialeah, review your paystubs and IRS notices, and present your case directly to the collections department. Depending on your circumstances, I may negotiate an installment plan, prove financial hardship, or even pursue an Offer in Compromise. Every case is unique, and that’s why my in-person, customized approach works better than “cookie-cutter” solutions. If your paycheck is at risk, acting quickly with professional help is the only way to keep your family secure.

A CP2000 notice is not a bill but a proposed adjustment when IRS computer systems detect income or mismatches. Ignoring it is a costly mistake. The IRS will assume you agree, assess the balance, add penalties, and begin collection. Over the years I’ve represented thousands of taxpayers who didn’t realize how serious these notices were until liens or levies hit them.

In Hialeah, many taxpayers work multiple jobs or have side income, making mismatches common. I personally sit with clients, review the CP2000 line by line, and prepare a professional response. Sometimes the IRS is wrong, and I can prove it with documentation. Other times, even if you owe, I can minimize penalties or negotiate payment terms.

With 20 years of experience, I know how to prevent a simple letter from snowballing into enforced collections. My ability to meet with you locally in Hialeah ensures we get the facts right, the response is timely, and your rights are fully protected.

Yes. A federal tax lien is the government’s legal claim against your property, including real estate, vehicles, and even future business income. For Hialeah residents, a lien can affect your credit, make it harder to sell or refinance property, and in some cases scare away potential business partners or lenders.

Unlike a levy, which seizes assets, a lien is more of a legal claim that attaches to your property until the debt is satisfied. Once filed, liens are public record in Miami-Dade County, meaning anyone—including landlords, lenders, or customers—can see it.

With over 20 years in practice, I’ve helped thousands of taxpayers negotiate lien releases, withdrawals, and subordinations. The good news is that liens can sometimes be avoided or removed if you act quickly. The IRS has programs that allow lien withdrawals after successful installment agreements, or if you qualify for streamlined resolution. If you’re in Hialeah, I can meet with you directly to review your real estate and business holdings and decide on the best course of action. The key is to get professional representation before the lien limits your financial future.

An Offer in Compromise (OIC) is the IRS program that allows taxpayers to settle their tax debt for less than the full amount owed. It’s often advertised as the “pennies on the dollar” program, but qualification is very strict. The IRS examines your income, assets, expenses, and future earning potential to decide whether accepting a reduced amount is in their best interest.

For residents of Hialeah, where many households face high living expenses compared to income, an OIC may be a viable solution. However, filing without professional guidance is risky—most self-prepared offers are rejected.

Over 20 years, I’ve successfully guided thousands of taxpayers through the OIC process, presenting detailed financial packages that maximize the chances of acceptance. I understand how the IRS evaluates local cost-of-living standards, which is critical in a city like Hialeah. If you hire me, I can meet with you in person to gather documents, prepare the offer, and negotiate directly with the IRS. My role is to help you avoid common mistakes, like overstating your assets or under-documenting your hardship, which often leads to rejections. With the right CPA on your side, an OIC can transform your financial life.

An installment agreement is one of the most common ways taxpayers resolve back taxes with the IRS. While it sounds simple—making monthly payments—it requires careful structuring to ensure affordability and compliance. The IRS has multiple types of agreements: streamlined, partial-pay, and non-streamlined, each with different thresholds and documentation requirements.

Many Hialeah taxpayers attempt to set these up themselves but end up agreeing to payments that strain their household or business budget. With my 20+ years of experience, I’ve negotiated thousands of installment agreements that balance the IRS’s demands with my clients’ real financial ability.

I meet with clients in Hialeah to review income, expenses, and assets, then prepare the proposal with supporting documents the IRS expects. If your case involves a revenue officer, I represent you directly so you don’t have to face the pressure alone. The benefit of professional representation is that I can prevent default, restructure agreements when needed, and even negotiate penalty abatements alongside the payment plan. In-person strategy sessions ensure your installment agreement doesn’t just solve today’s issue but also supports long-term financial stability.

Unfiled returns are one of the biggest red flags for the IRS. If you live in Hialeah and haven’t filed for years, the IRS can create a “Substitute for Return” (SFR) based only on income reports from employers and banks. These assessments often overstate taxes owed because they don’t include deductions or credits you’re entitled to. Once assessed, the IRS can begin collections with liens or levies.

With 20 years of tax resolution experience, I’ve helped thousands of non-filers come back into compliance without unnecessary penalties. My approach is to sit with you in Hialeah, reconstruct your income and expenses, file accurate back returns, and then negotiate the best resolution possible. In many cases, once accurate returns are filed, the liability drops substantially.

I also work to minimize the risk of criminal referrals by showing voluntary compliance before the IRS initiates enforcement. Being proactive, with a CPA who has direct experience in these situations, can make the difference between a manageable solution and a devastating enforcement action.

While rare, the IRS does have the legal authority to seize primary residences in extreme cases. More commonly, they will seize investment property, vehicles, or bank accounts. For a Hialeah resident, the risk increases if the balance is large, multiple notices have been ignored, and no effort has been made to resolve the debt.

I’ve represented clients facing property seizures, and with 20 years of experience, I know how to intervene before the situation reaches that point. By filing appeals, negotiating hardship status, or arranging settlements, I can often protect your home and assets.

Meeting face-to-face in Hialeah allows me to understand your personal situation and craft a defense tailored to your circumstances. Thousands of South Florida taxpayers have trusted me to defend their property rights, and my proven track record demonstrates that professional representation makes all the difference when property is on the line.

IRS penalties and interest can double or triple the size of a tax debt if left unchecked. Common penalties include failure-to-file, failure-to-pay, and accuracy-related penalties. Interest accrues daily, making balances grow quickly. In Hialeah, where many taxpayers juggle multiple jobs or small businesses, it’s easy to fall behind and watch penalties snowball.

One of the most effective tools I use after 20+ years of experience is penalty abatement. By showing reasonable cause — illness, natural disaster, or reliance on bad advice — I’ve helped thousands of clients remove tens of thousands in penalties. I also strategize to minimize future interest by structuring faster resolution methods.

Meeting with me in person in Hialeah ensures I can fully understand your hardship story and present it compellingly to the IRS. Professional representation not only reduces what you owe but also gives you peace of mind knowing someone with decades of experience is advocating for you.

Resolving an IRS problem is only half the battle — staying compliant going forward is critical. Many taxpayers in Hialeah resolve a debt only to fall back into trouble within a few years. My approach as a CPA with 20 years of experience goes beyond just fixing the immediate issue.

Once your case is settled, I meet with you in Hialeah to review your recordkeeping, withholding, and business practices to ensure future compliance. I’ve helped thousands of clients not only eliminate past tax problems but also implement systems that prevent recurrence. Whether it’s adjusting payroll withholdings, setting up estimated payments, or creating better bookkeeping habits, my long-term clients avoid the stress of repeated IRS contact.

Having a local professional you can call or meet in person gives you accountability and ongoing support. Tax resolution is not just about cleaning up the past — it’s about securing your financial stability for the future.

Payroll tax audits can be triggered by mismatches between what’s reported to the IRS and what’s filed with the Florida Department of Revenue. For Hialeah businesses, red flags include late filings of IRS Forms 941, discrepancies in W-2 or 1099 reporting, or unemployment claims that don’t align with payroll records. The Florida DOR is also aggressive in reviewing reemployment tax (formerly unemployment tax) filings.

In my 20+ years as a CPA, I’ve represented thousands of businesses during payroll tax audits. I’ve seen firsthand how small bookkeeping errors can escalate into five- or six-figure assessments. For Hialeah employers, the risk is especially high in industries with cash payments or high turnover, such as restaurants, construction, and transportation.

My approach is hands-on: I meet you at your business in Hialeah, review your payroll processes, and prepare audit defense documentation. Having professional representation often shifts the tone of the audit. Instead of being adversarial, it becomes a negotiation where I can highlight your compliance efforts and reduce penalties. My experience allows me to distinguish between honest mistakes and intentional noncompliance, ensuring your business is treated fairly.

The IRS uses a common-law test focusing on behavioral control, financial control, and the relationship of the parties. Simply issuing a 1099 does not make someone a contractor. In industries across Hialeah, particularly construction and services, this is a common audit issue. Misclassification can lead to back taxes, penalties, and interest on unpaid employment taxes. Florida DOR also applies similar tests for state reemployment tax.

With 20 years of experience, I’ve guided thousands of businesses through worker classification challenges. My process includes reviewing contracts, business practices, and control factors to build a strong defense. I meet directly with Hialeah employers to explain risks and restructure practices to avoid future misclassification claims.

Having a CPA who understands both IRS and Florida DOR standards is critical in avoiding devastating assessments.

The Trust Fund Recovery Penalty (TFRP) is one of the harshest tools the IRS uses. It allows them to assess payroll tax liability personally against owners, officers, or even check signers of a business. For Hialeah business owners, this means your personal assets — homes, cars, and bank accounts — can be at risk if payroll taxes aren’t deposited. Florida DOR has similar authority with state payroll taxes.

With 20 years of experience, I’ve defended thousands of clients facing TFRP investigations. I know the interview process the IRS uses and how to present documentation to limit or avoid personal liability. Meeting with you in Hialeah allows me to understand your business structure, prepare for interviews, and create a defense strategy that protects your personal assets.

My direct involvement often results in reduced exposure or negotiated settlements. This is not a risk any business owner should face alone.

Payroll tax debt accumulates quickly due to penalties and interest. For Hialeah businesses, this can become overwhelming, leading to threats of levies or even business closure. My 20+ years of experience include resolving payroll tax debts for thousands of businesses in South Florida. I negotiate installment agreements, apply for penalty abatement, and in some cases structure Offers in Compromise.

I’ve worked with both the IRS and Florida DOR collections divisions, and I know the local revenue officers personally. This inside knowledge helps me create realistic solutions. I meet you at your Hialeah location to review payroll records, cash flow, and compliance history. From there, I build a resolution plan that satisfies the authorities but also keeps your business operating.

Professional representation makes the difference between losing control of your business and regaining financial stability.

IRS Form 941 is used to report quarterly federal payroll taxes. Missing deposits or filings can result in severe penalties, often 10–25% of the unpaid tax, plus daily interest. The IRS views payroll taxes as “trust fund” money withheld from employees, so enforcement is aggressive. For businesses in Hialeah, especially those with tight margins, falling behind on deposits is common but dangerous.

With 20+ years of experience, I’ve helped thousands of businesses catch up on delinquent Form 941 filings, negotiate penalty abatements, and structure repayment plans. I can meet you at your location in Hialeah, review your payroll system, and implement solutions that keep you compliant moving forward.

The key is not to wait — once the IRS sends notices, they can levy accounts or initiate TFRP investigations. Having a CPA with decades of payroll tax resolution experience ensures you get the fastest and most favorable outcome.

Yes. The Florida Department of Revenue has authority to place liens, levy bank accounts, and in severe cases, suspend business operations for failure to comply with payroll tax obligations. Many business owners in Hialeah underestimate the DOR’s enforcement powers, but they can act quickly if quarterly reemployment tax reports are missing or payments are delinquent.

With over 20 years of experience, I’ve represented thousands of business owners in negotiations with the DOR, often preventing shutdowns by demonstrating good faith compliance efforts and arranging repayment plans. I personally visit your business in Hialeah, assess payroll records, and work directly with DOR agents to keep your doors open.

Professional representation can mean the difference between a negotiated settlement and forced closure.

Unresolved payroll tax issues create a cascade of problems. Beyond IRS and Florida DOR penalties, you risk losing bank financing, damaging relationships with employees, and even personal liability through TFRP assessments. For over 20 years, I’ve guided thousands of businesses through payroll tax crises, ensuring they come out stronger and more compliant.

My focus is not only on resolving the debt but also on setting up sustainable systems so you don’t repeat mistakes. I sit with you in Hialeah to assess payroll practices, identify weaknesses, and implement fixes. This hands-on approach builds long-term stability and protects your ability to grow.

Tax resolution isn’t just about survival; it’s about creating a foundation for expansion.

Penalties often make up half or more of payroll tax debt. The IRS assesses penalties for late filing, late deposits, or misclassification, and Florida DOR adds its own. In my 20+ years, I’ve secured penalty abatements worth millions of dollars for South Florida businesses. My strategy combines legal arguments with compelling narratives of reasonable cause.

For Hialeah business owners, I meet in person to document hardships, cash flow crises, or reliance on professional advice that led to errors. These stories, presented professionally, often convince the IRS or DOR to remove or reduce penalties.

Having represented thousands of cases, I know what works and what doesn’t, and I tailor defenses to your situation.

Faster than most realize. Missing one quarter’s deposits can lead to immediate penalty assessments, and by the second or third quarter, the IRS may assign a revenue officer. Florida DOR also acts quickly when reemployment tax filings are missing. Within months, you could be facing levies, liens, or even seizure of receivables.

In my two decades of practice, I’ve seen businesses spiral from minor issues to catastrophic in under a year. The advantage of working with me is immediate intervention — I can contact the IRS or DOR, pause enforcement, and negotiate manageable solutions. Meeting you in Hialeah allows me to move faster, because I can collect documents and financials in person.

Thousands of businesses have trusted me to stop problems before they become unmanageable.

The best resolution is prevention. After resolving payroll tax debt, I meet with Hialeah businesses to implement systems that keep them compliant. This includes setting up EFTPS reminders, restructuring payroll processes, and training staff on proper worker classification.

With over 20 years of experience, I know where businesses typically fail and how to fix it. Thousands of clients I’ve represented now operate confidently without fear of audits or levies. Having me as your CPA means having ongoing support — someone who not only resolves crises but also ensures they don’t return.

Prevention is a critical part of long-term tax health, and my local, in-person guidance gives Hialeah business owners the confidence to grow without looking over their shoulder.

Yes, the Florida Department of Revenue (DOR) regularly audits businesses for sales tax compliance. Triggers include discrepancies between reported sales and federal income tax returns, industry risk factors, or tips from competitors or disgruntled employees. In Hialeah, industries like restaurants, convenience stores, and wholesale distributors are frequent targets.

With 20 years of experience, I’ve defended thousands of businesses in DOR audits. I know the documentation they demand, from Z-tapes to exemption certificates, and how to present them effectively. Meeting at your Hialeah business, I prepare audit binders, reconcile sales reports, and negotiate directly with DOR auditors.

My goal is to minimize assessments and protect your cash flow. Many times, audits end with reduced liability or penalty abatements when properly handled. Without professional representation, small mistakes can turn into six-figure bills. Having a CPA with local knowledge ensures the audit doesn’t derail your business.

Unremitted sales tax is considered theft of state funds. Florida DOR aggressively pursues these cases, sometimes even referring them for criminal prosecution. For Hialeah businesses, this can mean bank levies, license revocation, or worse.

With my decades of experience, I’ve helped thousands of business owners negotiate repayment plans and avoid criminal charges by demonstrating good faith compliance efforts. Meeting you at your location, I assess your records and build a defense strategy to show the DOR that repayment is possible.

My role is to protect both your business and your personal freedom. Waiting too long increases risk — acting with a professional by your side makes the difference between a civil resolution and criminal exposure.

DOR auditors often use indirect methods to estimate sales, such as analyzing purchase records, industry ratios, or bank deposits. If your reported sales don’t match these estimates, they may assume underreporting and assess tax on the difference. For Hialeah business owners, especially in cash-heavy industries, this is a common audit issue.

I’ve defended thousands of clients against inflated estimates. My strategy includes reconciling POS reports, reviewing supplier invoices, and documenting legitimate nontaxable sales. Meeting with you in Hialeah allows me to access records directly and prepare a detailed audit defense.

Without professional help, you may end up paying tax on phantom sales. My 20 years of experience ensure that assessments are fair and supported by accurate documentation.

Missing returns are one of the fastest ways to get flagged by the Florida DOR. If returns aren’t filed, the DOR will create estimated assessments, often much higher than actual liability. For Hialeah business owners, this can quickly escalate into liens or license suspension.

I’ve represented thousands of businesses over 20 years and know how to correct these situations. My process includes filing accurate back returns, negotiating abatements of penalties, and structuring manageable repayment terms. Meeting with you in Hialeah ensures I can gather the necessary records and file quickly to prevent further enforcement.

Correcting missing returns promptly shows good faith, which often leads to reduced penalties. Having a CPA handle the process ensures accuracy and protects your rights.

Yes, the DOR has the authority to suspend your sales tax certificate and effectively shut down your business if you fall behind. I’ve defended thousands of businesses from forced closures by negotiating repayment terms or filing appeals.

For Hialeah business owners, I meet on-site to review financials, assess liabilities, and prepare a compliance plan. Acting quickly is essential — once your certificate is suspended, you cannot legally operate.

With 20 years of experience, I know how to restore compliance and protect your ability to continue operations. Many cases can be resolved before reaching suspension if handled by a professional early in the process.

Florida DOR imposes penalties for late filing, late payment, and underreporting, often 10% of the tax due per month, plus interest. For Hialeah businesses, balances can double in less than two years if ignored.

With my decades of experience, I’ve helped thousands of businesses secure penalty abatements by showing reasonable cause — such as illness, natural disasters, or reliance on incorrect advice. Meeting locally in Hialeah, I work with you to document your hardship and negotiate directly with the DOR.

Removing penalties and reducing interest saves businesses tens of thousands of dollars. Professional representation ensures that the DOR views your case favorably and applies relief where possible.

Preparation is key. I meet with Hialeah business owners before auditors arrive to review records, organize exemption certificates, and reconcile sales data. Having represented thousands of audits in my 20+ year career, I know the questions auditors will ask and the documentation they expect.

My role is to prevent unnecessary exposure by controlling the flow of information. Businesses that handle audits on their own often provide too much, leading to inflated assessments. With professional representation, the audit stays focused and fair.

I sit with you in Hialeah throughout the process, ensuring your rights are protected and your liability minimized.

Restaurants, convenience stores, auto dealers, and wholesale distributors are frequent audit targets due to cash transactions and high sales volumes. In my 20 years of practice, I’ve defended thousands of businesses in these industries. For Hialeah, with its vibrant food and retail markets, audits are common.

My strategy includes industry-specific defenses — reconciling supplier invoices, defending nontaxable sales, and preparing cash reconciliation reports. Meeting with you in Hialeah allows me to understand your business operations and tailor defenses.

Industry experience is critical, and my track record gives clients confidence that audits will be handled professionally.

Large assessments can cripple a business. Florida DOR offers installment agreements, but negotiating terms requires professional advocacy. I’ve helped thousands of businesses in South Florida structure payments that allow them to stay open while satisfying the DOR.

My process includes reviewing cash flow, preparing financial statements, and meeting with DOR collections officers. Being based near Hialeah, I can meet in person, understand your financials, and advocate for a realistic solution.

My 20+ years of experience give me insight into how far the DOR is willing to compromise, ensuring your agreement is sustainable.

The key to preventing future problems is building compliance into daily operations. After resolving cases, I meet with Hialeah business owners to implement systems for accurate recordkeeping, timely filings, and staff training on taxability rules. Many industries in Hialeah, like restaurants and retail, have frequent staff turnover, which makes errors common.

With 20 years of experience, I’ve guided thousands of businesses into compliance systems that keep them off the audit radar. Ongoing professional support means you have someone to call with questions before they become problems.

Prevention is not just about avoiding penalties — it’s about giving your business the confidence to grow without fear of the next audit.

¿Puede el IRS cerrar mi negocio en Hialeah por impuestos atrasados?

Sí, el IRS tiene la autoridad para embargar cuentas bancarias, colocar gravámenes en propiedades, y en casos extremos, cerrar operaciones hasta que se resuelva la deuda. Con la ayuda de un CPA en Hialeah, FL, usted puede negociar acuerdos de pago y evitar que esto ocurra.

Do food industry companies in Hialeah get audited more often?

Yes. Businesses in food production and distribution often have thin margins and complex inventory, making them high audit targets. IRS tax resolution services in Hialeah, FL help prepare documentation and defend deductions.

What happens if I ignore a CP2000 notice?

If ignored, the IRS will assume you agree with the proposed changes and will assess the additional tax, penalties, and interest. This can lead to enforced collection actions. Engaging a CPA in Hialeah, FL ensures that your response is accurate and timely.

Final Invitation

As a local CPA, I understand the pressures Hialeah business owners face every day. My role is to provide clarity, defend your rights, and create a path forward. Whether you run a factory, a trucking company, or a bakery, IRS tax resolution services in Hialeah, FL are here to protect you.

Déjeme ayudarle a proteger su negocio y su tranquilidad. Vamos a revisar su caso juntos.