As a CPA with over 20 years of experience representing businesses in Florida, one of the most common and stressful challenges I see clients face is a sales tax audit by the Florida Department of Revenue (DOR). If your business is located in Doral, FL, and you’ve received a notice from the Florida DOR, this guide will walk you through what to expect, why it happens, and how a professional CPA can help you navigate the process. I’ll also share the hard truths: many audits go badly because owners or bookkeepers attempt to handle things themselves or keep records in disarray. This is where experience makes all the difference.

Why the Florida DOR Initiates a Sales Tax Audit

The Florida DOR selects businesses for audit for a variety of reasons:

- Industry targeting (restaurants, retail, construction, and service industries are high on the radar).

- Discrepancies between filed returns and reported income.

- Whistleblowers or competitor complaints.

- Late or missing sales tax returns.

- Random selection based on audit programs.

If you’ve received a notice, it usually means the DOR already sees potential red flags. The audit is not random—it’s targeted.

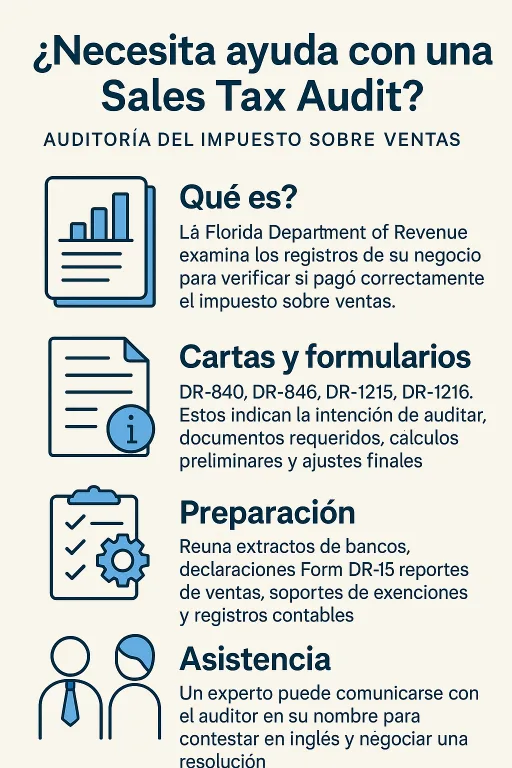

The Audit Letter: What You Will Receive

The process begins with a letter from the Florida Department of Revenue. The most common initial communication is the “Notice of Intent to Audit Books and Records.” This letter will:

- Identify the period under review (usually 3 years, sometimes more).

- Request access to books, records, and supporting documentation.

- Provide a date for the auditor’s arrival or a deadline for submission.

Other follow-up letters may include:

- Information Requests (DR-846): Specific lists of documents, such as POS reports, sales journals, or bank statements.

- Preliminary Audit Findings: A breakdown of proposed adjustments.

- Final Assessment Notice: If adjustments are made and tax, penalties, and interest are assessed.

Each of these letters has strict deadlines. Missing a deadline escalates penalties and limits your ability to dispute findings.

The Records They Expect to See

The Florida DOR expects businesses to maintain:

- Detailed sales journals and general ledgers.

- Point-of-sale (POS) reports.

- Copies of filed sales tax returns.

- Exemption certificates for non-taxable sales.

- Bank statements and merchant account summaries.

- Purchase invoices.

If you can’t produce these in an organized fashion, you’re already at a disadvantage.

When Books Are in Disarray

This is where many businesses in Doral run into serious problems during a Florida DOR sales tax audit. If your records are incomplete, inaccurate, or simply non-existent, the auditor will not wait patiently for you to get organized. They will move forward with whatever information they can obtain — often from bank statements, POS summaries, or third-party reports — and create an assessment that usually inflates your tax liability.

As a CPA specializing in Florida DOR sales tax audit help, I often find that the root problem is unqualified bookkeeping. Too many businesses in Doral rely on a family member, a part-time assistant, or a general office employee to manage QuickBooks or POS reconciliations. Without formal training or CPA oversight, errors compound over time:

- Sales are booked in the wrong periods.

- Exempt transactions are not properly documented with resale or exemption certificates.

- Cash sales are underreported or never reconciled.

- Merchant account deposits don’t match reported gross sales.

- Payroll and expense allocations are blended into sales reports.

When this happens, the audit defense becomes a reconstruction project. I am often forced to rebuild three to five years of sales tax records from scratch using alternative data sources:

- Bank Statement Analysis: Pulling every deposit, categorizing taxable versus non-taxable revenue, and reconciling inconsistencies.

- POS Reconciliation: Extracting daily or monthly reports from restaurant and retail systems, matching them against deposits.

- Merchant Services Records: Using credit card sales data as a baseline to prove actual gross receipts.

- Vendor Invoices: Identifying when sales tax was paid on purchases to avoid double taxation.

- Cash Flow Analysis: Estimating cash sales where deposits do not provide a complete picture.

This process can take weeks or even months, depending on the size of the business and the quality of whatever records remain. But without this reconstruction, the DOR will apply their own estimation methods, and those methods almost always result in higher assessments.

Why Poor Records Hurt During a Florida Sales Tax Audit

The Florida DOR has broad authority to assess taxes when records are inadequate. If you can’t provide proof, the auditor can:

- Assume all sales are taxable unless documented otherwise.

- Apply industry average markups to purchases and calculate sales from there.

- Use one month of data to extrapolate three years of sales.

- Rely on external data (such as liquor purchase reports for restaurants) to argue underreporting.

These approaches rarely favor the taxpayer. I’ve seen assessments double or triple a business’s actual liability simply because exemption certificates were missing or the books were a mess.

Why You Need Florida DOR Sales Tax Audit Help

If you are facing this situation in Doral, the worst thing you can do is try to clean up your books and argue with the auditor yourself. The very bookkeeping issues that caused the problem will be magnified under scrutiny. Every statement you make can lock you into a position that’s difficult to defend later.

By engaging a CPA who specializes in Florida DOR sales tax audit help, you give yourself a fighting chance to:

- Reconstruct records in a defensible manner.

- Push back against flawed DOR estimation methods.

- Document exempt sales properly and recover missing certificates where possible.

- Negotiate reductions in penalties and interest.

- Avoid costly mistakes in communication.

How I Defend Clients When Records Are a Mess

When I take over a case, my first step is to stop all direct communication between the business owner and the auditor. I become the single point of contact. Then I triage the records:

- Collect all bank statements, merchant account summaries, and available POS reports.

- Identify gaps and create a timeline of sales activity.

- Reconcile deposits to sales tax filings.

- Highlight discrepancies and prepare defensible explanations.

- Negotiate with the DOR to ensure only accurate, supportable adjustments are made.

I also prepare my clients for the reality that some liability may remain. But instead of a wildly inflated assessment, we arrive at a number that is grounded in actual records and defensible accounting work. That difference can mean survival for many Doral businesses.

Frequently Asked Questions — Florida DOR Sales Tax Audit Help

Florida DOR Sales Tax Audit — FAQs

You will receive a formal Notice of Intent to Audit Books and Records (Form DR-840). This begins a 60-day notice period before the audit, unless you waive it. The audit may be conducted at your place of business (field audit) or at the auditor’s office (desk audit).

The typical review period is three years. However, if you have failed to file or filed substantially incorrect returns, the DOR may extend the lookback further.

You should be ready to provide:

- General ledgers and journals

- POS reports and merchant summaries

- Exemption and resale certificates

- Filed Florida tax returns

- Bank statements and supporting schedules

If you cannot produce accurate records, the DOR may estimate your liability. This often means assuming all sales are taxable or applying industry averages to your business. These estimates are rarely in your favor.

The Florida DOR often prefers electronic audits. They may use software to analyze transaction-level data from your POS or accounting systems. Sampling methods, such as stratified statistical sampling, may also be applied to estimate liability.

Yes. While they are primarily enforcement tools, audits can also highlight bookkeeping weaknesses and areas where compliance needs to improve.

You have the right to challenge proposed adjustments, request audit conferences, and file formal protests. You may also pursue appeals if you disagree with the final assessment.

A sales tax audit can escalate quickly, especially if records are in disarray. A CPA experienced in Florida DOR audits can help reconstruct records, negotiate with auditors, challenge inflated estimates, and protect your rights throughout the process.

The Bottom Line

If your books are in disarray and you’ve been contacted for a sales tax audit in Florida, you need professional Florida DOR sales tax audit help immediately. Attempting to handle it alone will almost always lead to higher assessments, steeper penalties, and unnecessary stress.

This is not the time to cut corners or hope it will resolve itself. It requires detailed reconstruction, expert negotiation, and a CPA who has been through this process countless times. If you’re a Doral business owner facing these challenges, reach out today. I can help you organize, defend, and resolve your audit — so you can focus on running your business instead of fighting with the Florida Department of Revenue.

Official Links (Florida DOR & Florida Law)

Audit Process & Guidance (Florida DOR)

- What to Expect from a Florida Tax Audit

- What to Expect from a Florida Sales & Use Tax Audit (GT-800022)

- Sales & Use/Communications Services Tax Audit Timeline (GT-800023)

- Sampling and Your Audit (GT-800059)

- Auditing in an Electronic Environment (GT-800050)

Rights, Protests & Appeals

- Taxpayer’s Bill of Rights (overview)

- Florida Taxpayer’s Bill of Rights (GT-800039)

- Informal Dispute Resolution (IDR)

- How to Pay Your Audit Assessment & Notice of Taxpayer Rights (GT-800004)

- Rule 12-6.003, F.A.C. — Protest of Notices of Proposed Assessment (Adopted Rule page)

Sales & Use Tax Basics

- Florida Sales & Use Tax — Overview

- Sales & Use Tax Return (DR-15)

- Instructions for DR-15 (DR-15N)

- Sales & Use Tax Return — EZ (DR-15EZ)

- Florida Annual Resale Certificate for Sales Tax (GT-800060)

- Print Your Annual Resale Certificate (e-Services)

Statutes & Rules

- Florida Statutes — Chapter 212 (Sales & Use Tax)

- Florida Statutes — Chapter 212 (alternate official site)

- Florida Administrative Code — Chapter 12A-1 (Sales & Use Tax)