1) Transcripts: the IRS system log that decides your next move

An IRS transcript is the IRS’s ledger for a tax year: what you filed, what the IRS accepted or changed, what payments/credits hit, what penalties/interest accrued, and what enforcement or review flags were placed. Think of it as a timestamped event log. If you’re trying to resolve an IRS issue on your own, transcripts are the first, best tool to answer:

- What does the IRS think I filed?

- What numbers is the IRS working with now (after any IRS adjustments)?

- Why do I owe (or why was my refund held/changed)?

- What exactly has posted (payments, penalties, interest, offsets, refunds)?

- Did anything trigger an audit, hold, or collection action?

Mindset: Read your transcript like a timeline. Each line is a discrete event with a transaction code, a date, and an amount. Your job is to reconstruct the story.

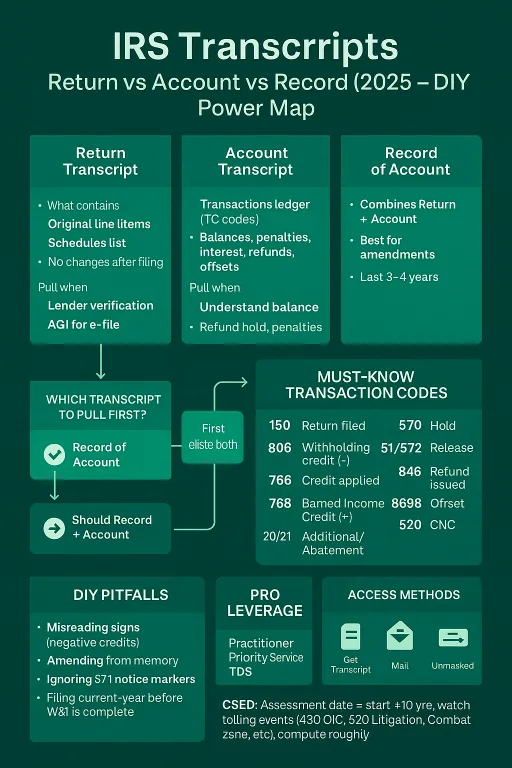

2) Transcript types (and when to use each)

Individuals commonly pull five types; business filers have analogous versions.

- Tax Return Transcript – Snapshot of what you originally filed (line items from your return).

Use when: a lender or third party wants to verify what you filed; you need your original numbers. - Tax Account Transcript – The running ledger: payments, penalties, interest, adjustments, refunds, offsets, balance updates.

Use when: you need to understand a balance due, a changed refund, or any IRS activity after filing. - Record of Account Transcript – Combines the two above into one file (return data + account activity).

Use when: you want the whole picture for a recent year; you plan to amend and need the IRS’s current figures. - Wage & Income Transcript – Consolidates information returns filed under your SSN (W-2, 1099 series, 1098, 5498, etc.).

Use when: reconstructing a missing return, validating what third parties reported, or checking for underreported income notices. - Verification of Non-Filing Letter – Confirms the IRS has no record of a filed return for a year.

Use when: a school, lender, or agency requires proof you didn’t file (and weren’t required to).

Business transcripts (for entities) include business return/account transcripts and, for payroll taxes, specialized formats for 940/941 series with amended return visibility.

3) How to obtain transcripts (DIY vs. professional channels)

DIY options

- Online portal: Fastest for individuals once your identity is verified. Download masked PDFs immediately.

- By mail/automated phone: Request select transcript types and receive paper copies at the address of record (typically 5–10 business days).

- Form 4506-T: Paper request for transcripts not available via self-service (older years, special requests). Mailed to you.

Professional channels (CPA/EA/Attorney)

- With an authorization (Form 2848 or 8821), a practitioner can:

- Pull multiple years/transcript types electronically through practitioner systems.

- Use practitioner phone lines that generally have shorter hold times and allow richer account discussions (multiple years in one call, targeted questions, rapid re-fax/secure delivery where permitted).

- Request certain internal views (through official channels) that surface statute dates, freeze codes, and case routing that aren’t obvious on public transcripts.

DIY reality check: If you’re blocked by identity verification, need many years quickly, or must reconcile several complex years, a pro can often retrieve and interpret everything in a single session.

4) Reading the format (what’s on the page and what it means)

Modern transcripts mask sensitive data (partial names/addresses, last-four SSNs/EINs) but show full dollar amounts. Expect:

- Header: transcript type, tax year, masked identity details, filing status.

- Return summary (if present): AGI, taxable income, total tax, total credits, refund/balance at filing.

- Account balance snapshot: sometimes labeled “Account balance plus accruals” as of a specific date. That’s tax + penalties + interest to that date (interest continues to accrue daily).

- Transactions table: date → transaction code → description → amount.

- Cycle codes: internal processing timestamps (year/week/day). Useful for timing but not essential.

Crucial convention: amounts use IRS ledger sign logic.

- Negative (-) amounts = credits in your favor (payments, withholding, refundable credits, abatements).

- Positive amounts = assessments/charges (tax, penalties, interest) or outbound disbursements recorded from the IRS’s books.

5) Transaction codes: a practical decoding index

Here are the high-signal codes you’ll see most often and how to interpret them in context. The descriptions below mirror the way they appear on transcripts but add practical strategy.

Core filing & refund flow

150 Return filed / tax assessed (+) total tax per processed return

806 W-2/1099 withholding credit (-) withholding credited as of due date

766 Credit to your account (misc) (-) refundable credits/adjustments

768 Earned Income Credit (-) EIC allowed

846 Refund issued (+) refund amount and issue date

841 Refund reversed/cancelled (-) refund taken back (returned mail, reject, offset unwind)

Holds, notices, amendments

570 Additional account action pending Freeze/hold (common with refund reviews)

571 Freeze resolved Hold lifted

971 Misc. transaction / notice issued Marker that a letter/notice was generated

977 Amended return filed 1040-X (or equivalent) posted; expect follow-on adjustments

Penalties, interest, adjustments

Penalties, interest, adjustments

196 Interest assessed (+) periodic interest postings on unpaid amounts

276 Failure-to-pay penalty (+) monthly accrual up to statutory cap

271/281 Penalty removed (-) penalty abatement postings

290 Additional tax assessed (+) generic assessment (math error, adjustment)

291 Abatement of tax (-) tax amount reduced/removed

300 Examination deficiency assessed (+) tax from audit/examination

Examination, appeals, litigation

Examination, appeals, litigation

420 Exam indicator Return selected for exam (not always leading to change)

421 Exam closed Case closed (often no-change)

424 Exam reassigned/postponed Case routing indicator

494 Statutory Notice of Deficiency 90-day letter issued; deadlines now run

520 Litigation/appeals freeze Collection/tolling while in court/appeals

522 Litigation/appeals closed Freeze lifted; next actions resume

Collections & special programs

Collections & special programs

460 Extension of time to file Extension granted (moves filing due date)

480 Offer in Compromise pending Collections tolled while OIC is evaluated

530 Currently Not Collectible (CNC) Collections suspended for hardship; accruals continue

582 Notice of Federal Tax Lien filed Public lien recorded for the module

583 Federal Tax Lien released Lien released after satisfaction/expiration

How to use the codes in practice

- Tell the story chronologically. Start at 150 (return posted). Layer in 806/766/768 to reconcile your refund/balance at filing. Then follow 290/291/196/276 to see why the balance changed. End at 846 (refund) or the latest balance snapshot.

- 570 present? Expect delay; look for a later 571 (freeze resolved) or 846 (refund issued).

- 977 present? Amended return posted—expect subsequent adjustments; use Record of Account to anchor the “per computer” numbers for your Form 1040-X.

- 494 present? You are in statutory-notice territory. Deadlines to petition run from that date.

- 480 present? OIC pending; collections paused; know that the statute is tolled during pendency.

- 530 present? CNC status; no active collections but interest/penalties continue until paid or statute expires.

6) Advanced DIY strategies (that most guides don’t tell you)

A. Anchor your math to the IRS’s current figures

Before you amend or pay, synchronize your numbers with the IRS’s ledger:

- Pull a Record of Account (recent years) or Account + Return (older years).

- Use the “per computer” or post-adjustment figures as your starting point on an amended return.

- If you rely on your original filing numbers after IRS math-error corrections, your amendment can be mis-keyed or rejected.

B. Reconcile every expected credit

Create a quick reconciliation table:

- Withholding (TC 806) = total of your W-2/1099-R/SSA withholdings.

- Estimated payments (TC 670) = match each quarter you sent.

- Extension payment (TC 660) = April payment with extension.

- Prior-year overpayment applied (TC 716).

If anything is missing, gather proof (cancelled check, IRS Direct Pay confirmation) and be ready to call.

C. Model interest and penalty trajectory

- Failure-to-pay (FTP) penalties (TC 276) accrue monthly on unpaid tax up to the cap; interest (TC 196) accrues daily on tax + certain penalties.

- If paying in full, call for a to-the-day payoff; if setting up a plan, understand how accruals affect total cost.

- After abatements (penalty relief), expect negative 271/281 postings and possibly 776 (interest reduction) to re-balance.

D. Know your Collection Statute Expiration Date (CSED)

- The collection clock is generally 10 years from assessment (first 150 or subsequent 290/300).

- Tolling events—like OIC pending (480), certain appeals/litigation (520), some time abroad, or bankruptcy—pause/extend the clock.

- If your transcript timeline suggests a near-CSED, be cautious about elections or agreements that could extend it.

E. Decode refund delays without guesswork

- 570 present → refund review/hold.

- 571 or 572 later → hold released (often followed by 846).

- 826/898 offsets → refund reduced or applied to other debts (you’ll see the amounts right on the ledger).

F. Treat 971 as a breadcrumb

- 971 marks that a notice/letter was generated. Pin the date; check your mail/email history for missing letters.

- If you never received it, you can ask the IRS to identify which notice (and reissue if appropriate).

G. Avoid the “masked info” trap when third parties need full identifiers

- Public transcripts mask SSNs/EINs and truncate names/addresses.

- When a third party needs unmasked details, request the appropriate unmasked transcript via paper channels.

- Keep masked transcripts for your analysis; use unmasked only when absolutely necessary and store securely.

7) Case studies (compact but realistic)

Case 1: “Why did my refund vanish?”

- Facts: Return e-filed in March. Transcript shows 150 (+ tax), 806/766 (credits), net refund expected. Then 570 posts in April. No 846 by May. In June, 971 (notice issued); taxpayer never saw it. July shows 826 (offset) to prior-year balance, and finally 846 with the smaller remainder.

- What happened: Refund was held for review (570), a notice was generated (971), then the IRS applied an offset (826) to an old debt before issuing the reduced refund (846).

- DIY move: Pull prior-year transcript to verify the target of the offset; if the prior-year balance is wrong (e.g., missing estimated payment), fix that year, then request an offset reversal if appropriate.

Case 2: “My amended return keeps failing”

- Facts: Taxpayer mailed a 1040-X using their original line items. Transcript shows their originally filed return had a math-error correction; Account Transcript reveals 290 (+$120) posted weeks after filing.

- What happened: The amendment used the wrong “original” amounts.

- DIY move: Pull Record of Account to get post-correction figures. Re-prepare 1040-X, anchoring Column A to the IRS’s current figures. Expect 977 to post, then either 291/290 as the IRS rebalances.

Case 3: “Should I start a payment plan or wait out the clock?”

- Facts: 2015 shows 150 assessed in 2016. Current year transcript shows 530 (CNC) in 2021. Taxpayer is considering an installment agreement in mid-2025.

- What happened: With a likely CSED in 2026, entering a new agreement now could extend the clock depending on the terms and actions taken.

- DIY move: Compute a CSED estimate (assessment + ~10 years), scan for tolling codes (480, 520). If close, weigh pros/cons of immediate agreement versus a short-term plan, partial pay, or pursuing penalty relief. Consider professional review to avoid inadvertently extending the statute.

8) Common DIY pitfalls (and how to dodge them)

- Reading signs backward. On IRS ledgers, negatives are good (credits to you), positives are charges. Misreading this flips outcomes.

- Amending from memory. Always anchor to the IRS’s current ledger (Record of Account) before you amend.

- Ignoring breadcrumb codes. 971 tells you a notice exists; 570 tells you to expect delay; 494 tells you the clock is running.

- Assuming the balance snapshot is static. Interest/penalties accrue. If paying in full, get a date-certain payoff; if negotiating, model accruals.

- Letting missing credits slide. Reconcile 670/660/716/806 entries; if a payment is missing, document and call.

- Extending the statute by accident. Certain elections and submissions toll/extend time. Scan your ledger for those codes before you commit.

- Spending hours on hold. Be realistic about time: practitioners typically reach specialized support faster and can handle multiple years per call.

- Underestimating emotional cost. Transcripts reduce uncertainty, but complex ledgers (multiple years, audits, statutes) can become an all-consuming project. Know when to bring in help.

9) DIY vs. Professional access and leverage

| Capability | DIY Taxpayer | CPA/EA/Attorney (with authorization) |

|---|---|---|

| Transcript retrieval speed | Online immediate / mail 5–10 days | Often same-day for multiple years via practitioner systems |

| Phone access | General lines; variable/long holds | Practitioner lines; typically shorter holds, more complex issue handling |

| Depth of data | Public transcripts (masked) | Public + authorized inquiries; guided access to internal views where permitted |

| Interpretation | Self-researched; risk of misreads | Experienced pattern recognition; rapid issue triage |

| Strategy | Self-devised; trial-and-error | Established playbooks (penalty relief, statutes, offsets, offers, appeals) |

| Time to resolution | Depends on learning curve | Often compressed due to tooling and experience |

Balanced view: You can absolutely DIY: pull, decode, reconcile, and act. The leverage a pro brings is speed, sequencing, and fewer blind spots—especially when multiple years and overlapping statutes/penalties collide.

10) A practical workflow you can follow today

- Collect: For each problematic year, download Tax Account and, if available, Record of Account. Add Wage & Income if you suspect unreported forms.

- Snap the baseline: Note Account balance + accruals and last posting date.

- Rebuild the story: Start at 150 (filed/assessed). Add credits (806/766/768). Track changes (290/291/300), penalties (276), interest (196), holds (570/571), and outcomes (846, offsets).

- Reconcile payments: Confirm 670/660/716/806 against your records. Identify any gaps.

- Decide action:

- Missing credits? Gather proof; call or write to fix.

- Amend? Anchor to post-correction figures; time your filing with transcript updates.

- Pay/plan? Get a payoff date; model accruals; consider relief options.

- Statute-sensitive? Map CSED; avoid extending inadvertently; time your moves.

- Document: Save PDFs, mark key codes/dates, and keep a one-page timeline per year.

- Escalate when warranted: If you see audit/deficiency/litigation flags or multi-year complexity, consider professional reinforcement.

- Pain points addressed: refund holds, missing credits, misread balances, amendment failures, surprise penalties, creeping interest, statute miscalculations, endless holds.

12) Closing perspective

You now speak enough of the IRS’s “code language” to audit your own IRS story—line by line, code by code, date by date. That alone puts you far ahead of most taxpayers. Transcripts surface the facts: what the IRS recorded, when, and why your balance or refund changed. With that clarity, your options become structured:

- Fix missing credits, amend correctly (from the IRS’s real baseline), time payments and relief requests, and avoid accidental statute extensions.

- Or, if you’re staring at multiple years, audit/deficiency markers, liens, and statute puzzles, hand your packet to a professional who can turn your transcript stack into a fast, sequenced resolution plan.

Either path is valid. The difference is time, certainty, and risk tolerance. If you want an expert to do a same-day sweep of all years, extract every transcript, compute statutes, and propose a resolution path tailored to your situation, that’s exactly what IRS Resolution Services are designed for. If you want to DIY, keep this guide close, be methodical, and let the transcript timeline be your north star.

(When you’re ready) What I can do next for you

- Pull and organize all your transcripts (multiple years) under a single authorization.

- Build a per-year timeline with plain-English summaries and action items (credits to fix, amendments to file, penalties to abate, statutes to watch).

- Map a 90-day plan to stabilize, resolve, and close.

If you want that level of certainty, send me your year list and we’ll start with transcript access. If you prefer to keep DIY-ing, ask for my Transcript Codes Cheatsheet and CSED Estimator when you’re ready—I’ll share them.

Frequently Asked Questions about IRS Tax Transcripts

Start with a Record of Account for each tax year—it combines the Return and Account transcripts, so you see both your original filing figures and all subsequent IRS adjustments and transactions (TCs). If a bank only asked for a “return transcript,” you can still pull Record of Account to avoid blind spots (e.g., later math-error changes). If you’re unsure which to request via paper, Form 4506-T explicitly says the Record of Account is the most complete.

Resources: IRS — Transcript Types for Individuals

DIY: Individual Online Account or Get Transcript gives same-day access to Return, Account, Record of Account, Wage & Income, and Non-Filing letters (mail and phone options exist if you can’t pass online verification). Pros with a filed authorization use the Transcript Delivery System (TDS) inside e-Services; it can be faster because it’s purpose-built, but you still need your authorization on file.

Resources: IRS — Get Transcript

For identity protection, IRS transcripts redact sensitive digits (SSN/EIN, phone, account numbers). The Customer File Number is a 10-digit tag you (or a lender) add so a third party can match a masked transcript to your file on their side. If a lender truly needs unmasked data, that’s generally done through IVES with Form 4506-C, not through standard transcripts.

Resources: IRS — About the New Tax Transcript

Current-year Account/Return data appears a few weeks after filing (longer for paper). For Wage & Income, IRS says current-year info is generally available by April, but not fully complete until mid/late spring (and sometimes later). If your return had a balance due and you didn’t pay in full, IRS indicates processing and transcript availability lag until mid-May/late May.

Resources: IRS — Transcript Availability

Anchor on these: TC 150 (return posted), TC 806 (withholding), TC 766/776 (credits), TC 570 (hold/freeze—additional liability/processing pending), TC 571/572 (release of hold), TC 846 (refund issued), TC 898 (refund offset to another debt). The authoritative code lists are in Document 6209 Section 8A, and IRM sections tie specific codes to actions (e.g., TC 846 under Refund Inquiries).

Resources: IRS — Document 6209 Section 8A

TC 971 = “Miscellaneous” action with an attached Action Code (AC) that explains what happened (e.g., ID theft indicator, installment agreement set-up, mirror account creation, etc.). Use Document 6209 Section 8C to map the Action Code; the entry often determines next steps (appeals deadlines, collections impacts, mirroring to MFT 31, etc.).

Resources: IRS — Document 6209 Section 8C

Not necessarily. TC 570 is a general “additional liability/processing pending” hold; freezes also appear for many reasons (math errors, identity verification, return integrity checks, etc.). Audit indicators are more specific (e.g., TC 420/424 examination controls) and certain freeze literals (“-L”) appear in IRS systems. Start with the freeze/TC entries, then check IRM “Freeze Codes” guidance to interpret what’s blocked and what releases it.

Resources: IRS — IRM 21.5.6 Freeze Codes

Yes—carefully. The 10-year clock generally runs from assessment (TC 150 or TC 290/300) but tolls (pauses) for events like bankruptcy, OIC pending (TC 480), CDP hearings, and more. Your transcript shows those codes/dates; you apply IRM 5.1.19 rules to compute elapsed vs. tolled time across all periods and mirrored modules (MFT 31). This is error-prone—double-check every tolling TC.

Resources: IRS — IRM 5.1.19 Collection Statute

Look for TC 530 entries (CNC). If a joint account was mirrored into MFT 31 modules (one per spouse), collection may be pursued or suspended separately; watch for TC 971 AC 109 and MFT 31 indicators. CNC can be reversed; transcripts will show subsequent collection activity or status changes.

Resources: IRS — IRM 5.16.1 CNC

TC 898 indicates a Treasury Offset Program application to non-IRS debts (student loans, child support, etc.). TC 826 is an offset to another IRS year. If you’re a joint filer and believe your share was taken for your spouse’s debt, consider Injured Spouse (Form 8379); IRM 21.4.6 covers offsets and injured spouse handling.

Resources: IRS — IRM 21.4.6 Offsets

TC 846 = refund issued. Timing and delivery depend on banking and routing correctness, and offsets may still reduce the amount. If the refund is missing, IRS directs you to Where’s My Refund / 800-829-1954 first; if an IRS error occurred, call 800-829-1040 to correct.

Resources: IRS — About Where’s My Refund

You need authority. For living taxpayers, IRS requires Form 2848 (POA) or Form 8821 (TIA) on file (CAF system). For a decedent, the personal representative (often with Form 56) can request the decedent’s transcripts. DIYers should expect identity and relationship verification.

Resources: IRS — Tax Topic 356

Amended returns (Form 1040-X) take up to 3 weeks to appear in systems and typically 8–12 weeks to process (up to 16 in some cases). Use Where’s My Amended Return for status; account transcripts update as the IRS posts adjustments (TC 290/291, etc.).

Resources: IRS — Where’s My Amended Return

Form 2848 (POA) authorizes a qualified representative to act on your behalf (discuss/argue issues, negotiate, receive transcripts). Form 8821 (TIA) only authorizes someone to access and receive information (e.g., pull transcripts) but not to represent you. Both are recorded to the CAF; digital options can speed posting.

Resources: IRS — Submit Power of Attorney

Practitioners with an authorization on file can use TDS and contact Practitioner Priority Service (PPS) for account resolution, while DIYers use general phone lines or a Taxpayer Assistance Center by appointment. The underlying transcript data is the same; the difference is tooling and routing.

Resources: IRS — Practitioner Priority Service

IRS processes accounts in weekly/daily cycles; transcripts show cycle codes that reflect when the Master File posts updates. They’re operational markers—not guaranteed refund dates. When in doubt, use official tools for refund timing and refer to IRM Processing Timeliness: Cycles for the framework.

Resources: IRS — IRM 3.30.123 Processing Timeliness

For joint 1040 liabilities (MFT 30), the IRS may mirror the account into two MFT 31 modules—one per spouse—when it needs to track/collect separately (innocent spouse, CNC by one spouse, exam reallocations, etc.). Transcripts will show the mirroring TCs (e.g., TC 971 AC 103/109/145). Treat each spouse’s transcript independently after mirroring.

Resources: IRS — IRM 25.15.15 MFT 31

Yes—IVES (Income Verification Express Service) lets lenders (with your consent) obtain Return, Account, Record of Account, and Wage & Income via Form 4506-C, often delivered electronically in hours. Use IVES when masked transcripts aren’t sufficient for underwriting.

Resources: IRS — Income Verification Express Service

Yes. Businesses can get Business Account and Return transcripts (e.g., 1120, 1065, 941) through “Get a Business Tax Transcript” and the Online Business Account. Timing mirrors individual rules: 2–3 weeks after e-file, 6–8 weeks for paper. Lenders can also use IVES for business with your consent.

Resources: IRS — Get a Business Tax Transcript

Absolutely. Transcripts show when penalties were assessed/reversed and often reveal Penalty Reason Codes after abatement (e.g., PRC 018/020 for First-Time Abate). Use them to confirm three-year “clean history” and filing/payment compliance before asking for First-Time Abate, or build a Reasonable Cause timeline.

Resources: IRS — Penalty Relief