When Family Steps In to Help With IRS Issues:

Meta Title: Net Operating Loss Rules & Family Tax Help | Ed Parsons, CPA

Meta Description: When a family member inherits a tax problem involving old NOLs or related-party losses, a detailed CPA review is essential before amending. Learn how we approach these cases.

Slug: /net-operating-loss-family-help-cpa

When Concern Turns Into Action

It’s common for adult children, spouses, or siblings to reach out when a loved one’s tax issues have gotten out of hand. I’m always grateful when families trust me to help, but I also remind them that it’s ultimately the taxpayer—not the relative—who must engage and authorize me to move forward.

Recently, I was contacted by someone who wanted to help his father sort through a long-standing IRS problem involving two corporations, a large loss from years ago, and ongoing consulting income. The family simply wanted “an amended return” prepared to correct what they believed was a missed deduction.

At first glance, that sounds straightforward. But as we unpacked the situation, the complexity became apparent.

A Tale of Two Corporations and One Persistent Loss

Here’s what we know:

- The father previously owned Corporation A, which either dissolved or transferred assets into Corporation B.

- A transaction between the two entities created what appeared to be a loss on the sale or contribution of a business asset.

- That loss produced a Net Operating Loss (NOL) more than six years ago.

- Each year since, that NOL has been used to offset ongoing consulting income.

- In one year, however, the preparer failed to apply the NOL—creating a large tax bill and an IRS collection case.

When the family came to me, their request was simple: “We just need an amended return.”

But as any seasoned CPA knows, amending a return without understanding the foundation of that loss can open a much larger can of worms.

My Diagnostic Approach as a CPA

Before filing or amending anything, my responsibility is to understand what actually happened—both factually and technically. Here’s the framework I use in cases like this:

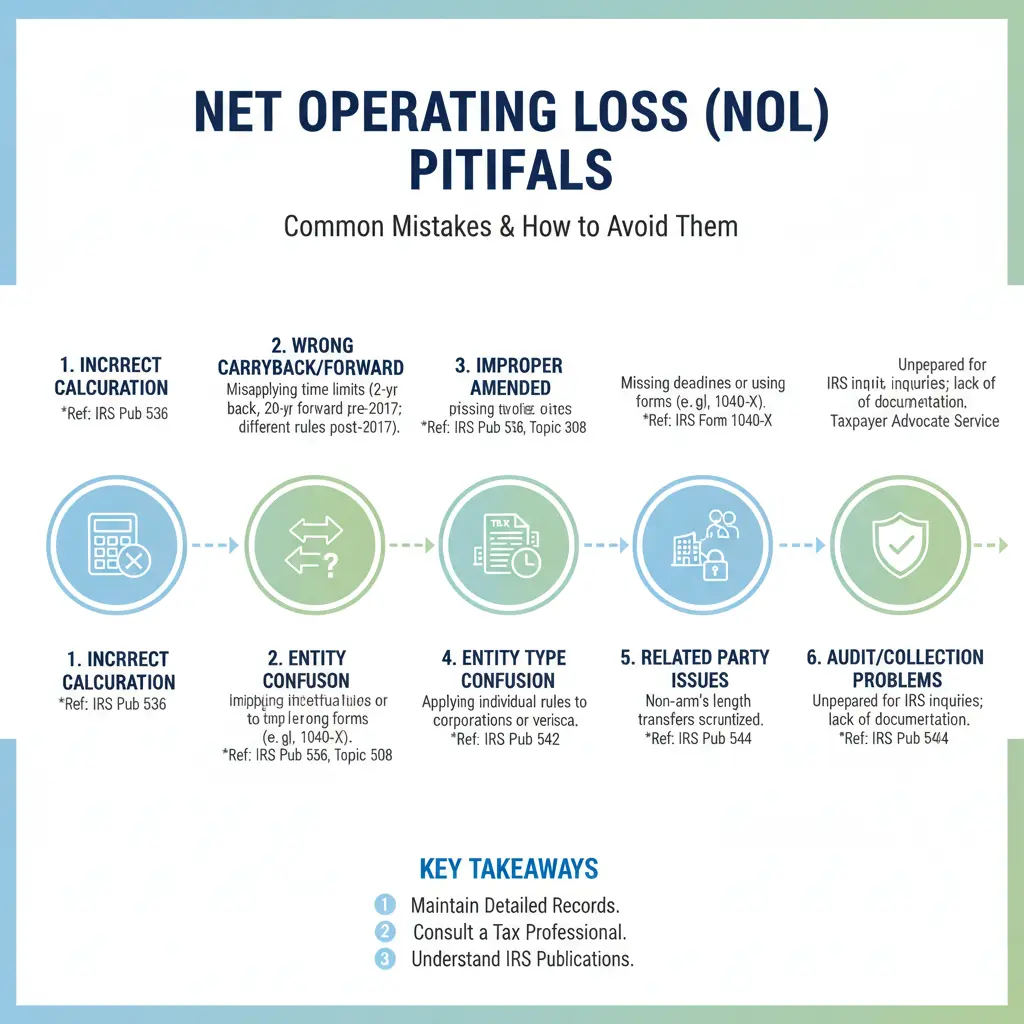

1. Verify the Existence and Validity of the NOL

- Was the loss properly created under IRC §172?

- Did it arise from a true business activity, or from a related-party or capital transaction?

- Was the NOL correctly calculated, carried forward, and applied each year?

2. Examine Related-Party and Built-In Loss Rules

- If the two corporations shared common ownership, IRC §267 or §384 could limit or defer that loss.

- Was there a built-in loss contributed to the new corporation? If so, the deduction may not be immediately available.

3. Trace the Corporate History

- What happened to the first entity—was it properly liquidated or merged?

- Are both corporations compliant, with final returns filed and accounts closed?

- Were there any basis adjustments or asset carryovers that were mishandled?

4. Review the NOL Carryforward Computation

- How did the prior preparer compute the NOL?

- Were there intervening years with other income types that change the carryforward?

- Has any portion of the NOL already been absorbed or expired under the time limits?

5. Confirm Whether the NOL Offsets Current Consulting Income

- Is the consulting income trade or business income or personal service income?

- If the NOL was business-related but current income is not, the offset may not apply as expected.

Why “Just an Amended Return” Isn’t Always the Answer

It’s tempting to think the problem ends with re-filing the missing deduction. But in this case, the taxpayer’s account is already assigned to an IRS revenue officer attempting to collect the outstanding balance.

That means once we present the amended return, the officer may request validation of the NOL—including the original calculation, source documentation, and entity records. If we can’t substantiate the loss, the amendment could invite additional scrutiny rather than relief.

Here’s how I approach this balance:

I will prepare the amended return—but only after validating the roll-forward NOL schedule as maintained by prior preparers.

This lets us move forward efficiently without reinventing the wheel. At the same time, I make sure the taxpayer understands that:

- We may be asked to substantiate the NOL later.

- We cannot take the NOL at face value without understanding how it originated.

- Depending on the quality of prior bookkeeping or recordkeeping, we may discover additional adjustments that affect the outcome.

In other words, I want to help—but not blindfolded.

The Balancing Act: Efficiency vs. Diligence

As a CPA, I’m always mindful of two competing obligations:

- Protecting the client’s resources. I don’t want to charge for unnecessary reconstruction if the NOL can be verified quickly.

- Protecting the integrity of the filing. I can’t put my name on an amendment that relies on an unverified or invalid NOL computation.

Sometimes the first step really is to amend the return and see how the IRS responds—but only after ensuring that we have a defensible foundation should further inquiry follow.

Lessons for Taxpayers and Families

- For family members: Your support matters. But remember, the taxpayer must authorize representation and make key decisions.

- For taxpayers: A loss from years ago may not be as straightforward as it appears. Verify before you claim.

- For professionals: Always trace the origin of an NOL before carrying it forward or applying it to new income categories.

The Takeaway: Clarity Before Action

The lesson here isn’t to fear complexity—it’s to respect it.

A quick amendment may feel like progress, but when IRS collection activity and multi-entity transactions are involved, we need to know exactly what’s beneath the surface.

If you’re in a similar situation—trying to help a parent or spouse with old tax losses and IRS notices—start with a clear, fact-based review. That’s the best way to protect everyone involved.

🧩 Frequently Asked Questions

Can a net operating loss from a dissolved corporation still be used?

It depends on how the corporation was liquidated and whether ownership continuity rules were met. The loss generally can’t survive if the entity no longer exists or ownership changed substantially.

What happens if a prior preparer missed an NOL deduction?

You can often amend to claim it, but only if the NOL was validly generated and properly carried forward.

Can related-party transactions create invalid losses?

Yes. The IRS disallows losses from sales or contributions between related parties to prevent artificial deductions.

Can I amend my father’s return on his behalf?

Only the taxpayer or their authorized representative can sign and file. A Power of Attorney (Form 2848) is required for a CPA to act on someone else’s behalf.

When Family Steps In to Help With IRS Issues: Understanding a Complex Net Operating Loss Case

It’s common for adult children, spouses, or siblings to reach out when a loved one’s tax issues have become overwhelming. …

Frequently Asked Questions

- Can a net operating loss from a dissolved corporation still be used?

- It depends on how the corporation was liquidated and whether ownership continuity rules were met. The loss generally can’t survive if the entity no longer exists or ownership changed substantially.

- What happens if a prior preparer missed an NOL deduction?

- You can often amend to claim it, but only if the NOL was validly generated and properly carried forward. Proper substantiation and calculation are critical before filing an amendment.

- Can related-party transactions create invalid losses?

- Yes. The IRS disallows or defers losses from sales or contributions between related parties to prevent artificial deductions. Specific Code sections (for example IRC §267) may apply.

- Can I amend my father’s return on his behalf?

- Only the taxpayer or their authorized representative can sign and file. A Power of Attorney (Form 2848) is required for a CPA to act on someone else’s behalf.