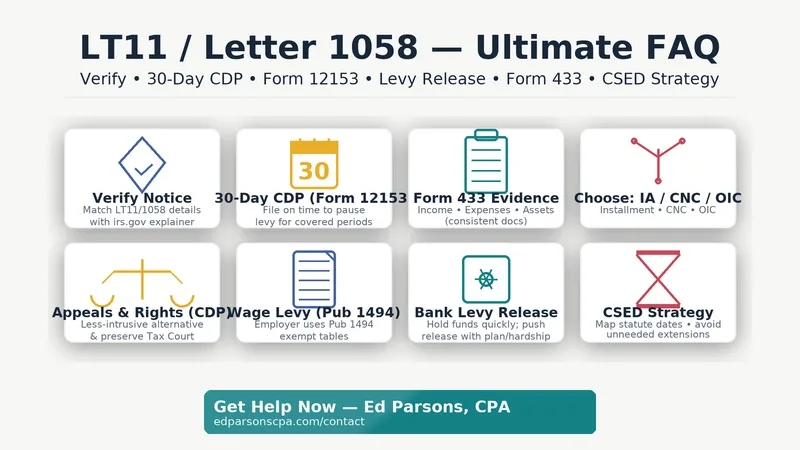

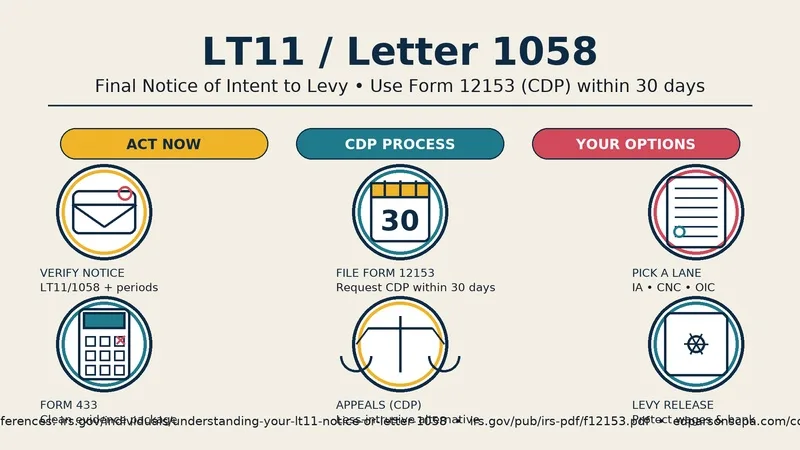

LT11 / Letter 1058 — Final Notice of Intent to Levy: Ultimate FAQ (CDP, Form 12153, Levy Release)

Opened LT11 (Letter 1058)? This Ultimate FAQ explains exactly what the Final Notice of Intent to Levy means, your 30-day CDP clock, and how to file Form 12153 correctly. You’ll see payment plan choices, CNC hardship, Offer in Compromise basics, wage/bank levy releases (Pub 1494), and CSED strategy—in plain English. If time is tight, Ed Parsons, CPA pulls transcripts, builds a bulletproof Form 433, and handles Appeals to halt enforcement. Free triage: https://edparsonscpa.com/contact/