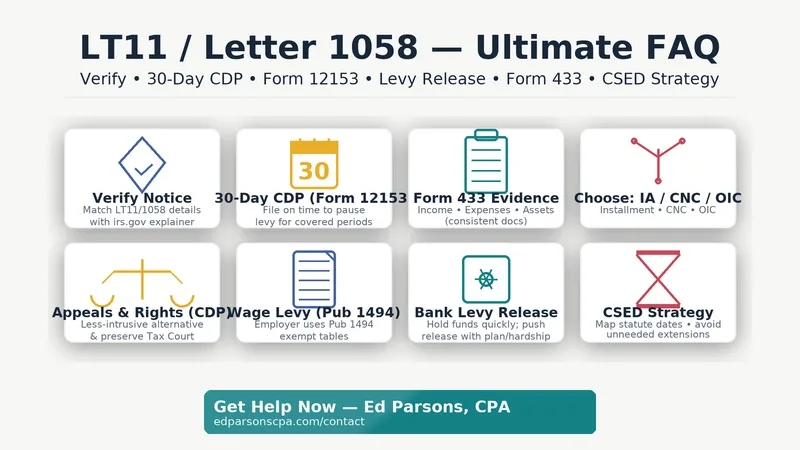

LT11/Letter 1058 Final Notice FAQ

Complete guide to Collection Due Process (CDP) hearings, Form 12153, levy protection, and tax resolution strategies

⚠️ URGENT: 30-Day Deadline

You have only 30 days from your notice date to request a Collection Due Process hearing and protect your rights. Don’t wait!

Verify & Legitimacy

Yes, LT11/1058 is a real IRS notice that means “Final Notice of Intent to Levy” and explains your right to a hearing. To verify in minutes: match the notice title and content against the IRS explainer “Understanding your LT11 notice or Letter 1058”.

Check that your notice lists the same tax periods, your name/SSN (masked), and provides an IRS number. If you have an online IRS account, confirm that your balance due and notice history reflect the same tax year(s).

Practical protection: Never scan or text images of your ID, and never pay by gift card/wire to anyone claiming to be IRS. Real LT11/1058 letters typically arrive by certified mail and expressly state your option to request a Collection Due Process (CDP) hearing.

If you want a pro to sanity-check the document, Ed Parsons, CPA can review the notice, pull transcripts, and confirm internal IRS codes that correspond to your case timeline. Contact Ed Parsons, CPA for verification assistance.

No. LT11/1058 is the final warning that the IRS intends to levy unless you act, and it opens your strongest appeal channel (CDP). The IRS page “Understanding your LT11 notice or Letter 1058” confirms the “intent to seize property or rights to property” language and urges immediate contact.

A levy can follow if you do nothing, but if you file Form 12153 on time for a CDP hearing, the IRS generally suspends levy action for the periods listed while Appeals reviews your case.

What this means for you: Act before the deadline (usually 30 days from the date on the notice) so you preserve your Tax Court rights and stop new levy moves for the covered periods during the Appeals review.

Ed Parsons, CPA will map every tax period, confirm any active levy flags on transcripts, and sequence next steps so you don’t stabilize one year while another remains exposed. Contact Ed for same-day triage.

Yes, the IRS can be wrong about your balance. Common errors include: miscalculated penalties, incorrectly applied payments, duplicate assessments, or penalties assessed despite meeting abatement criteria (first-time penalty relief, reasonable cause, etc.).

The LT11/1058 notice doesn’t prove the liability is correct—it just means the IRS intends to collect what’s on their records unless you challenge it through proper channels.

Your CDP hearing rights are specifically designed for this situation. When you file Form 12153, you can request that Appeals review not just collection alternatives, but also the underlying liability including whether the amounts, penalties, and interest calculations are correct.

Act fast: You have only 30 days to preserve your right to challenge the liability and petition Tax Court if Appeals disagrees with you. Missing this deadline limits your options significantly.

Ed Parsons, CPA immediately pulls transcripts to spot calculation errors, penalty issues, and payment mispostings, then builds both the liability challenge and collection alternative into your CDP strategy. Don’t pay what you don’t owe—contact Ed.

Timeline & Deadlines

The 30-day clock typically runs from the date printed on your LT11/1058, not the day you opened it. To preserve full CDP rights and pause levy action for the listed periods, you must submit Form 12153 within that window.

File by certified mail (keep the receipt) or by fax if your notice provides a fax option. Include a copy of the notice with your request, as directed by Form 12153 (PDF).

Missed the deadline? You still can request an Equivalent Hearing within 1 year of the notice date, but you’ll lose the automatic levy suspension and the right to petition Tax Court if you disagree with Appeals.

If this is already day 28-30, Ed Parsons, CPA can organize a same-day filing (12153), start building your Form 433 financial package, and open a line to the IRS to prevent surprises. Contact for urgent help.

Setting up a payment plan (installment agreement) may stop levy moves in practice—especially if the plan is approved and you make the first payment—but it’s not a substitute for preserving your appeal rights.

If you disagree with the proposed collection action or need Appeals to consider a less intrusive alternative (lower monthly payment, hardship/CNC, or an Offer in Compromise), you should still file Form 12153 before your 30-day deadline.

Why file 12153 anyway? A timely CDP request typically suspends levy action for the covered periods and gives you access to Tax Court if you disagree with Appeals. If you only set up a plan with Collections and skip CDP, you may have fewer options if the plan amount is unrealistic.

Strategy tip: When time is short, file 12153 to lock in rights, then pursue the fastest good-faith arrangement with Collections while your full proposal is prepared for Appeals. Ed Parsons, CPA manages both tracks so you don’t miss a window. Start at edparsonscpa.com.

Military in combat zones: The 30-day period is automatically suspended during your deployment and for 180 days after you return, per IRC Section 7508. Make sure the IRS has record of your military status.

Civilian overseas: The deadline generally doesn’t extend just because you’re traveling, but if you’re a bona fide resident of a foreign country, consult with a tax professional about available extensions.

Emergency/hospitalization: If you’re incapacitated during the deadline period, you may qualify for relief under reasonable cause provisions, but this requires documentation and isn’t guaranteed.

Practical solutions: You can file Form 12153 by fax from anywhere in the world if your notice provides a fax option. You can also authorize someone to file on your behalf with proper power of attorney documentation.

Ed Parsons, CPA handles emergency filings for clients worldwide and maintains power of attorney relationships for situations exactly like this. If you’re facing a deadline while unable to act personally, contact Ed immediately for emergency filing assistance.

CDP vs. CAP & Equivalent Hearing

A timely CDP hearing (requested with Form 12153) is generally the strongest protection after LT11/1058. It can suspend levy action for the periods at issue while Appeals reviews whether a less intrusive alternative (installment, CNC, OIC) fits your facts.

If you still disagree after Appeals, a timely CDP preserves your right to petition U.S. Tax Court. See CDP FAQs and the Internal Revenue Manual overview IRM Part 5.

CAP (Collection Appeals Program) is faster for specific disputes (e.g., levy already issued, lien action, seizure), but it doesn’t allow you to contest the underlying tax and doesn’t provide Tax Court review.

Good rule of thumb: If your 30-day CDP window is still open, use CDP. If it’s closed and enforcement is acute, CAP may help while you work a sustainable resolution with Collections.

Ed Parsons, CPA tailors that sequence to your facts, often filing CDP to pause levy risk and then using the Appeals process to secure an agreement you can actually keep. Questions? Contact Ed.

If the 30-day window has passed, you can still request an Equivalent Hearing within one year of the LT11/1058 date. An Equivalent Hearing puts your case before Appeals, but it doesn’t pause levy action automatically and doesn’t preserve Tax Court review.

CAP, on the other hand, can sometimes be faster to address a particular action (e.g., a levy you believe is improper), but again no Tax Court review and no challenge to the underlying liability through CAP.

Practical approach: When enforcement pressure is high, you usually need a two-track plan—(1) request the Equivalent Hearing to get Appeals involved and (2) simultaneously negotiate with Collections for a hold or a quick installment while you assemble a complete Form 433 package.

Ed Parsons, CPA builds a single, reconciled case file (transcripts, CSED map, Form 433 with documentation) and handles the communications for you. Start here: edparsonscpa.com/contact.

You can (and often should) do both simultaneously. Filing Form 12153 for a CDP hearing preserves your strongest rights, while also negotiating with Collections for an immediate installment agreement or other arrangement.

Why this dual approach works: The CDP filing suspends levy action for the covered periods and preserves Tax Court rights. Meanwhile, a payment arrangement with Collections can provide immediate stability and demonstrate good faith to Appeals.

Typical sequence: File Form 12153 immediately to lock in rights, then contact Collections to set up a reasonable interim payment while your full financial package is prepared for the Appeals hearing.

Avoid conflicts: Make sure any arrangement with Collections doesn’t undermine your position with Appeals. For example, agreeing to a payment you can’t sustain just to stop immediate enforcement can hurt your hardship argument later.

Ed Parsons, CPA coordinates both tracks strategically—filing CDP to preserve your rights while negotiating realistic interim arrangements that support (rather than undermine) your ultimate resolution with Appeals. Get coordinated representation from Ed.

How-To: Form 12153 & Financial Disclosure

Download Form 12153 (PDF) here. The form instructs you to send the request to the address on your LT11/1058 (the hearing request address, not the payment address) and to include a copy of your notice.

What to include beyond the form:

- A one-page cover letter stating you’re making a timely CDP request, listing periods, and describing the resolution you propose (installment/CNC/OIC)

- A Form 433-A/433-B draft or a statement that your full financial package will follow promptly

- Any quick evidence that supports a hold (e.g., hardship items)

Send by certified mail and keep a complete copy of everything plus the mailing receipt. If there’s a fax option on your notice, keep the fax confirmation page.

If the clock is tight, file the 12153 immediately to lock in rights; then finish your 433 package for Appeals. Ed Parsons, CPA routinely files the form the same day and coordinates follow-up with Appeals/Collections. Contact Ed for white-glove help.

Expect to document income, necessary living expenses, and assets. Typical items include:

- Paystubs or 1099s

- The last 2-3 months of bank statements for all accounts

- Housing and utilities bills

- Insurance, medical out-of-pocket

- Child care or court-ordered obligations

- Transportation costs

- Statements for retirement/brokerage accounts and loans

If self-employed, also provide a recent profit & loss and business bank statements.

Make it bulletproof by ensuring consistency: (a) bank deposits ≈ stated income (explain any exceptions); (b) expenses tie to bills and are reasonable under IRS standards; and (c) asset values are supported (statements, loan payoffs).

This is where Ed Parsons, CPA excels—he reconciles every number across your documents, catches issues that would trigger requests for more info, and presents a package Appeals can adopt. See Ed’s Advanced Guide to IRS Transcripts for deeper technical insights.

Fatal mistake #1: Sending to the wrong address. Always use the specific hearing request address printed on your LT11/1058, not the payment address or general IRS address.

Fatal mistake #2: Missing the 30-day deadline by even one day. The IRS is strict about this—late filings only qualify for Equivalent Hearings with no levy suspension or Tax Court rights.

Fatal mistake #3: Vague or contradictory relief requests. Don’t just check the “installment” box—specify a realistic monthly amount and explain why it’s appropriate based on your income and necessary expenses.

Other critical errors: Forgetting to include a copy of your notice, not keeping certified mail receipts, failing to sign the form, or providing inconsistent information that suggests you’re not being truthful about your financial situation.

Ed Parsons, CPA has filed thousands of Forms 12153 and knows exactly how to avoid these pitfalls. He ensures proper addressing, timing, documentation, and consistency so your case gets the full protection of CDP rights. Don’t risk fatal mistakes—let Ed handle your filing.

Resolution Paths (Choose a Lane)

If your balance and compliance status qualify, a streamlined installment agreement may be the fastest way to stop enforcement and keep life predictable. When your case falls outside streamlined limits, you’ll need a non-streamlined plan supported by Form 433 documentation.

Appeals evaluates whether your plan is no more intrusive than necessary and sustainable. A realistic, well-supported payment beats a heroic number that will default.

Sizing the payment: Take your net income – necessary expenses (verified by bills) and propose a number you can actually make until the balance is gone or CSED intervenes. If a higher payment would cause you to miss basics (housing, utilities, food, medical), look at CNC hardship instead.

Ed Parsons, CPA models each option—including how it affects CSED and whether it risks extending the statute—so you choose a lane that meets IRS standards and preserves your quality of life. Ed Parsons, CPA — IRS Tax Resolution.

You may qualify for CNC hardship if paying anything would cause you to miss necessary living expenses. CNC places your account in a status where the IRS does not actively collect, though interest and penalties continue and the IRS may file a lien.

You’ll disclose finances on Form 433 and show, with documentation, that you have no disposable income after allowable expenses.

CNC is not a permanent pardon—if your situation improves, the IRS can review and resume collection. But CNC is often the right move when an installment payment would simply default.

Strategy matters: Sometimes CNC now and a later Offer in Compromise (if facts support it) produce better outcomes than forcing a payment you can’t maintain.

Ed Parsons, CPA builds the hardship case with bills and transcripts, positions your account for CNC during the CDP review, and sets up a monitoring plan so you stay protected. Contact Ed for confidential hardship review.

An OIC can settle your debt for less when your Reasonable Collection Potential (RCP) is lower than what you owe. It’s documentation-heavy and success depends on accurate valuation of income, expenses, and assets.

You shouldn’t file an OIC if you’re missing required returns or estimated payments. The IRS OIC program overview is here: Offer in Compromise.

At the CDP stage, the key question is whether your numbers actually support an OIC. If they do, proposing OIC during Appeals can be efficient; if not, a realistic installment or CNC will be faster and more predictable.

Filing a weak OIC can waste months and risk enforcement resuming later. Ed Parsons, CPA calculates RCP properly (including how equity and income standards apply in your locale), explains trade-offs (like statute suspensions during OIC consideration), and chooses timing that helps—not hurts—your long-term outcome.

Want to talk through RCP math before you commit? Ed Parsons, CPA — Contact.

Multi-stage strategies can be highly effective when your current situation doesn’t fit neatly into one resolution path. For example, you might start with CNC hardship status to stop immediate collection, then file an OIC once you’ve gathered complete documentation and improved your compliance.

Common hybrid approaches: Partial pay installment agreement (if you can’t pay in full but can pay more than minimum living expenses) followed by OIC for the remaining balance; temporary CNC while business recovers, then convert to realistic installment; or short-term installment to carry you past CSED on older tax years.

Timing is critical with combination strategies. Each resolution path has different effects on Collection Statute Expiration Dates, and some actions can suspend or extend CSED in ways that hurt rather than help your long-term position.

Appeals officers often appreciate taxpayers who present realistic, phased approaches rather than demanding impossible solutions. The key is showing good faith and providing a clear timeline for how you’ll transition between phases.

Ed Parsons, CPA specializes in sophisticated, multi-stage tax resolution strategies. He models the CSED impacts, sequences the timing optimally, and presents the plan to Appeals in a way that maximizes acceptance. Need a complex strategy? Contact Ed.

Levy Mechanics & Releases

With a wage levy, you don’t lose your entire paycheck. Your employer must compute the exempt amount you keep using Publication 1494, based on your filing status and dependents for the year the levy is served.

The portion above that exempt amount is sent to the IRS each pay period until the levy is released. IRS guidance also explains wage levy basics here: Information about wage levies.

To secure a release, you typically need an approved alternative—a viable installment, CNC hardship, or a pending OIC where appropriate—or you must show the levy is causing economic hardship contrary to policy.

If your employer miscalculated the exempt amount, correcting the 1494 inputs can slightly improve take-home while we work the release. Ed Parsons, CPA handles both fronts: presenting the resolution to the IRS and coordinating with your employer so the levy math is right during the interim.

A bank levy generally hits what’s in the account on the day the levy is served (up to the amount owed). Banks hold funds briefly, then send them to the IRS unless a levy release arrives in time.

Whether you can recover the funds depends on showing hardship or quickly securing an approved alternative and persuading the IRS to issue a release before the bank transmits.

Policy context appears in the IRM: IRM 5.11.1 – Pre-levy actions/restrictions and legal references in IRM 5.17.3 – Levy and Sale.

If the money already left the bank, reversals are harder but still possible in narrow situations (e.g., demonstrated economic hardship). The better tactic is prevention—a timely CDP request plus a credible plan—and, if a levy is imminent, fast submission of your 433 with proof of hardship.

Ed Parsons, CPA accelerates that paper trail and pushes the release track while building the longer-term agreement so you don’t face repeat levies. Immediate triage: edparsonscpa.com/contact.

Beyond wages and banks, the IRS can levy business accounts, accounts receivable, rental income, retirement distributions (when paid out), and even third-party payments like commissions or contractor payments from your clients.

Retirement funds in qualified plans (401k, IRA) are generally protected while they remain in the account, but distributions become subject to levy. Business accounts offer no special protection—they’re treated like any other bank account.

Protection strategies: File Form 12153 before the 30-day deadline to suspend levy action during your CDP hearing. For business accounts, consider separating personal and business tax liabilities, and maintain clear documentation of business vs. personal funds.

If you’re self-employed or have rental properties, the IRS may serve third-party levies on your clients or tenants, requiring them to send your payments directly to the IRS. This can be devastating to your business relationships and cash flow.

Ed Parsons, CPA helps business owners and independent contractors strategically structure their accounts and timing to minimize exposure, while negotiating agreements that prevent disruptive third-party levies. Protect your business—contact Ed today.

CSED & Strategy

CSED is the Collection Statute Expiration Date—when the IRS’s time to collect a given assessment runs out. Certain actions can suspend or extend CSED (for example, a timely CDP request tolls collection for the covered periods while Appeals/Tax Court are pending; an OIC also suspends during consideration).

Why it matters: A plan that unnecessarily extends CSED without delivering relief (e.g., an unrealistic long plan that will default) can cost you years. Conversely, a smart plan can carry you past CSED on some modules while resolving others.

Ed Parsons, CPA pulls transcripts, plots each period’s CSED, and then designs the plan (installment vs. CNC vs. OIC) with the statute in mind. That’s how you avoid hidden traps—like agreeing to a payment that looks fine today but keeps you in collections far longer than necessary.

For individualized CSED mapping, see Ed’s Advanced Guide to IRS Transcripts and contact Ed.

This depends on three key factors: (1) whether you have valid grounds to challenge the underlying liability, (2) your financial capacity to pay, and (3) how much time remains on CSED for each tax period.

Challenge the liability if: You never received proper notices, the IRS made calculation errors, you have innocent spouse grounds, or penalties were assessed incorrectly. A timely CDP hearing preserves your right to raise these issues and petition Tax Court if Appeals doesn’t agree.

Focus on payment alternatives if: The liability is solid but you can’t pay in full without hardship. Even then, consider whether a long installment plan extends CSED unnecessarily compared to CNC or a shorter plan.

Quick full pay makes sense if: You have the funds available, the liability is correct, and paying now ends the stress without extending statutes or risking future compliance issues.

Ed Parsons, CPA reviews transcripts for procedural issues, evaluates your liability challenges, and models the financial impact of each approach—including how CSED affects your long-term exposure. Get a strategic assessment from Ed.

You absolutely can (and often should) use different strategies for different tax periods, especially when the years have different CSED dates, different factual issues, or different collection potential.

Smart segmentation example: Years with short CSED remaining might be good candidates for CNC or minimal installment payments, while newer years with longer collection time might justify an OIC or realistic installment agreement.

During your CDP hearing, Appeals will evaluate each period individually. You might propose: “CNC hardship for 2019 and 2020 (CSED expires in 18 months), installment agreement for 2021-2022 (recent years), and challenge the penalty assessments on 2021 for procedural issues.”

What you can’t do is ignore some periods while addressing others—the LT11/1058 covers specific years, and Appeals expects a comprehensive resolution proposal for all listed periods.

Ed Parsons, CPA maps each year’s timeline, collection potential, and any liability issues, then architects a period-by-period strategy that maximizes your leverage and minimizes total cost over time. See Ed’s multi-year planning approach.

Aftermath & Prevention

The most common default triggers are missing a payment, incurring new debt, or failing to file/pay on time going forward. To avoid this:

- Dial in withholding (W-4) or set quarterly estimates

- Put your installment on auto-pay for the day after your paycheck clears

- Avoid new balances by making estimated payments the same day you receive self-employment income

- Keep a small buffer in your checking to avoid a single missed draft

Ed’s approach is to align the resolution with your cash-flow reality and then “compliance-proof” it: refine W-4, set calendar reminders for estimates, and schedule a 30-/90-day check-in so small issues don’t become defaults.

If life happens (job change, medical event), tell your representative immediately so the plan can be renegotiated before it breaks.

For a full resolution + prevention roadmap, see IRS Tax Resolution CPA – Stop Garnishments & Levies Fast.

Federal tax liens: If a Notice of Federal Tax Lien (NFTL) was filed, it typically remains until the balance is paid in full or the CSED expires. However, you may qualify for lien withdrawal or subordination if you’re in a qualifying agreement and meet specific criteria.

Account monitoring: Even after your installment agreement is established, the IRS continues to monitor your compliance with current filing and payment obligations. They’ll also review your financial condition periodically—especially for non-streamlined agreements.

Clean slate timeline: Once all balances are fully satisfied, the IRS typically releases liens within 30 days. Your credit report should reflect the release, though you may need to follow up with credit bureaus.

Ongoing compliance is key: new balances can trigger default of your existing agreement and restart enforcement. Ed Parsons, CPA helps clients stay compliant with future filing/payment obligations and monitors IRS account activity so small issues don’t escalate.

If you resolve your current situation but continue having filing or payment issues, yes—you could face future enforcement notices. The best prevention is a three-part compliance strategy:

1. Fix the root cause: Whether it’s inadequate withholding, poor estimated payment planning, or business cash-flow issues, address what caused the original problem. Don’t just treat the symptoms.

2. Build systems: Set up automatic withholding adjustments (W-4), quarterly estimate reminders, separate tax savings accounts for self-employed income, and annual compliance check-ins with your tax preparer.

3. Monitor proactively: Check your IRS account online quarterly, stay current with notices, and address small balances before they grow into collection cases.

If your business or income is irregular, consider working with a CPA who can help you estimate quarterly payments accurately and adjust them as circumstances change.

Ed Parsons, CPA doesn’t just resolve current problems—he builds systems to prevent future collection issues. This includes W-4 optimization, estimated payment planning, and business cash-flow management for self-employed clients. Learn about Ed’s prevention-focused approach.

Get Professional Help with Your LT11/Letter 1058

Don’t navigate this complex process alone. Ed Parsons, CPA has helped thousands of taxpayers successfully resolve their IRS collection issues through strategic CDP hearings and negotiations.

Schedule Your Consultation TodayWorking with Ed Parsons, CPA

Hour 0-4: Verify & Map. Ed validates the notice against irs.gov resources (LT11 explainer) and pulls transcripts to map assessments, notices, and CSED for each tax period. If other periods are exposed outside the LT11, he flags them so nothing blindsides you.

Hour 4-12: File & Protect. If your 30-day clock is running, Ed prepares and files Form 12153 by certified mail or fax per the notice, and drafts a clean cover letter stating your proposed resolution (installment/CNC/OIC). He also begins the Form 433 packet and may contact Collections to request a hold while Appeals takes jurisdiction.

Hour 12-48: Build the Case. Ed reconciles bank deposits to income, organizes bills to IRS standards, and sizes a payment you can keep—or documents hardship for CNC—or models OIC if warranted. If a wage levy already hit, he confirms your employer is using Publication 1494 tables correctly and pursues a levy release once your alternative is accepted.

Throughout, he keeps a call log, tracks deadlines, and communicates for you so you can focus on work and family.

Ready to steady the situation? Contact Ed Parsons, CPA for a confidential LT11/1058 triage and CDP strategy.

- Verify the notice here: Understanding your LT11 notice or Letter 1058. Note the date and calculate your 30-day deadline.

- File Form 12153 for a CDP hearing before the deadline: Form 12153 (PDF). Send to the hearing address on the notice; include a copy of the notice. Use certified mail.

- Choose a lane: streamlined or non-streamlined installment, CNC hardship, or OIC—see Publication 594 for the collection process.

- Build Form 433 with clean documentation (income, necessary expenses, assets).

- Appeals hearing: present a resolution that is “no more intrusive than necessary”; if you disagree with Appeals and your CDP was timely, you can seek Tax Court review.

- Prevent default: fix withholding/estimates and set auto-pay.

Need help executing this checklist under a tight clock? Ed Parsons, CPA — IRS Tax Resolution and Contact.