LT11 / Letter 1058 — Final Notice of Intent to Levy & Your CDP Rights (Form 12153): The Ultimate Deep Dive

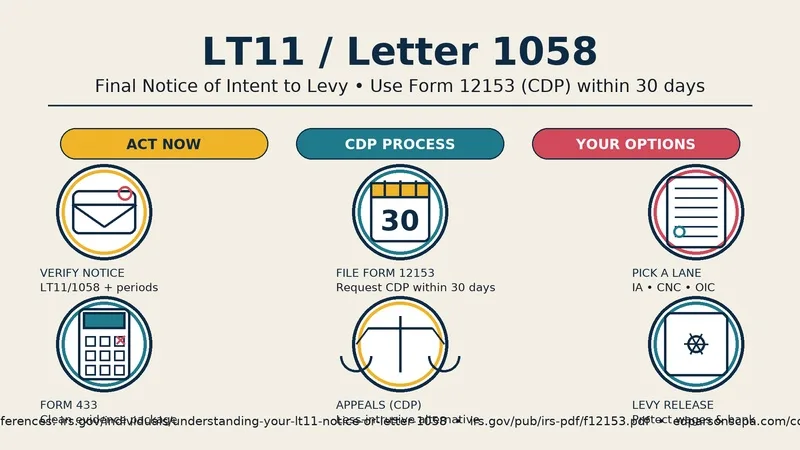

If you just opened an envelope marked LT11 or Letter 1058, you’re staring at the IRS’s Final Notice of Intent to Levy. It’s the pointy end of the collection process—the letter that means the government can start taking your money (wages, bank funds, and more) if you don’t act. The good news: you still have rights and you still have options—especially if you move quickly and methodically. This guide walks you through what LT11/Letter 1058 means, how the Collection Due Process (CDP) hearing works, exactly how to use Form 12153, and how a seasoned representative like Ed Parsons, CPA can protect you, stabilize your case, and negotiate an outcome you can actually live with.

This isn’t theory. It’s the playbook for stopping panic, organizing your facts, and using your rights to prevent a levy or get one released.

1) What LT11 / Letter 1058 means (and how it differs from earlier notices)

LT11/Letter 1058 is the IRS’s final notice before levy—an alert that the IRS intends to seize your property or rights to property to collect unpaid tax. It also informs you of your right to request a CDP hearing with the IRS Independent Office of Appeals. By the time this notice lands, you’ve typically passed earlier reminders (CP14, CP501, CP503, CP504). The LT11/1058 marks the point where inaction becomes dangerous because the next step can be a levy. Read the IRS explainer here: Understanding your LT11 notice or Letter 1058 (https://www.irs.gov/individuals/understanding-your-lt11-notice-or-letter-1058).

Two key things to understand:

- It’s not a levy by itself, but the last notice before levy and the one that grants your strongest appeal rights (CDP).

- It starts a short clock (generally 30 days from the date on the letter) to file Form 12153 and preserve those rights. If you miss that window, you may still request an Equivalent Hearing, but you’ll lose certain advantages (like going to Tax Court if you disagree with Appeals). For how CDP works, review Collection Due Process (CDP) FAQs (https://www.irs.gov/appeals/collection-due-process-cdp-faqs).

2) The CDP hearing, in plain English (why timely Form 12153 matters)

A Collection Due Process (CDP) hearing is your opportunity to get an independent Appeals review of proposed collection action. When you file Form 12153 on time (within the LT11/1058 deadline), you generally halt levy action for the periods covered while Appeals reviews your case and any alternative you propose (installment agreement, hardship/CNC, Offer in Compromise, lien alternatives, etc.). You also preserve the right to petition U.S. Tax Court if you disagree with the Appeals determination—a powerful check against unreasonable collection. See CDP FAQs (https://www.irs.gov/appeals/collection-due-process-cdp-faqs).

Form 12153 itself is straightforward, but timing and attachments matter. The form instructs you to send it to the hearing request address on your notice (not the payment address) and to include a copy of the notice. If you’re unsure about the correct mailing or fax options, the form specifically tells you to call the number on your notice. Download Form 12153 (PDF) (https://www.irs.gov/pub/irs-pdf/f12153.pdf).

3) Timeline: 30 days, certified mail, and what “timely” really buys you

- The 30-day window is measured from the date on your LT11/1058, not the day you opened it. The IRS uses that date to evaluate whether your CDP request is timely. If you submit on time, levy action is generally suspended for the periods listed on the notice while Appeals reviews your case. See Understanding your LT11 notice or Letter 1058 (https://www.irs.gov/individuals/understanding-your-lt11-notice-or-letter-1058) and CDP FAQs (https://www.irs.gov/appeals/collection-due-process-cdp-faqs).

- If you miss the 30-day deadline, you can still request an Equivalent Hearing within one year of the notice date, but you usually won’t get levy suspension or the right to go to Tax Court afterward. See the CDP FAQs (https://www.irs.gov/appeals/collection-due-process-cdp-faqs).

- Mail Form 12153 via certified mail with tracking and keep a complete copy of your packet. If you fax, keep the fax confirmation sheet.

One more nuance: filing a request for Appeals does not necessarily pause collection for periods not listed in your request (or for other tax modules). If you have multiple years due, your representative should be precise about what’s included and vigilant about what isn’t. The IRS’s IRM 5.19.8 (https://www.irs.gov/irm/part5/irm_05-019-008) discusses collection appeal rights at a policy level.

4) What a levy actually looks like (and why the exempt amount matters)

A levy can target bank accounts, wages, or other income. If a wage levy is served on your employer, you won’t lose your entire paycheck. The IRS sends Publication 1494 (https://www.irs.gov/pub/irs-pdf/p1494.pdf) with the levy; your employer uses those tables to determine the exempt amount that you still take home. Everything over that exempt amount is sent to the IRS each pay period until the levy is released. That’s still painful—which is why we try to prevent the levy in the first place by filing a timely CDP and presenting a workable alternative.

For bank levies, the bank generally holds the balance on the day the levy hits (up to the amount due) and then sends it to the IRS after the hold period unless the levy is released first. Preventing the levy or getting it released quickly is the name of the game. For a high-level overview of collection mechanics, read Publication 594: The IRS Collection Process (https://www.irs.gov/pub/irs-pdf/p594.pdf).

5) Your resolution “lanes”: pay in full, payment plan, hardship (CNC), Offer in Compromise

Appeals doesn’t just decide “levy or no levy.” They examine whether a less intrusive alternative will collect the tax efficiently while respecting your rights and basic living needs. That means your CDP hearing should be anchored to a clear, documented proposal:

- Pay in full (now or within a short window).

Fastest way to end collection and minimize interest going forward. Confirm payoff amounts and posting dates; if you need a few days to move funds, propose a short, specific date and follow through. - Installment agreement (streamlined or non-streamlined).

- Streamlined agreements fall under preset thresholds; documentation is lighter and approval is faster.

- Non-streamlined agreements require Form 433-A (individuals) or 433-B (businesses) with supporting documents (paystubs, bank statements, P&L if self-employed, proof of expenses). The key is a realistic monthly payment that you can sustain for the life of the agreement.

Publication 594 outlines the IRS collection process and the role of agreements at a high level—see Publication 594 (https://www.irs.gov/pub/irs-pdf/p594.pdf).

- Currently Not Collectible (CNC) hardship.

If paying anything would cause you to miss necessary living expenses, you can request CNC status. You’ll complete a Form 433 package and provide documentation. CNC pauses active collection but doesn’t stop interest; the IRS may revisit later if your finances improve. See Publication 594 (https://www.irs.gov/pub/irs-pdf/p594.pdf). - Offer in Compromise (OIC).

This is a settlement for less than the full amount when your Reasonable Collection Potential is lower than what you owe. OIC requires careful math, complete documentation, and strategic timing (for example, you generally shouldn’t be in an open bankruptcy or have unfiled returns). If your numbers don’t support it, it won’t be accepted—so pre-qualify before you file. Explore the program at Offer in Compromise (https://www.irs.gov/payments/offer-in-compromise).

A strong CDP package doesn’t just say, “Please stop.” It proves why your alternative is reasonable, documents your facts, and complies with filing/payment requirements going forward (for example, adjusting W-4 withholding or making quarterly estimates so you don’t default a new agreement).

6) Exactly how to prepare Form 12153 and your CDP “evidence” packet

Form 12153 has just a few core parts: your information, the type of appeal (CDP or Equivalent), the basis (lien, levy, or both), and your proposed resolution. What moves the needle is the packet behind it:

- Cover letter (one page): cite the notice date and the tax periods, affirm it’s a timely CDP request, and state the relief you’re pursuing (e.g., non-streamlined installment based on enclosed Form 433-A and documentation).

- Form 12153 completed and signed; copy of the LT11/Letter 1058. Address it to the hearing-request address on the notice, which is different from the payment address. Download Form 12153 (PDF) (https://www.irs.gov/pub/irs-pdf/f12153.pdf).

- Form 433-A (and/or 433-B) with clean, consistent documentation:

- Income: paystubs, bank deposits, 1099s, year-to-date payroll summaries.

- Expenses: rent/mortgage statement, utilities, insurance, medical out-of-pocket, child care, court orders, transportation, taxes.

- Assets: bank/brokerage statements, retirement, vehicles, real property, business equipment.

Your numbers must reconcile across documents (for example, bank deposits should roughly match reported income unless you explain exceptions).

- Plan terms: proposed monthly payment with date, or OIC/CNC rationale; if you’re requesting CNC, explain the hardship in plain, factual terms and show it with the 433 and bills.

- Compliance plan: how you will avoid new balances (W-4 adjustments, estimates). Appeals officers pay attention to future compliance because new debt can default agreements.

Finally, send by certified mail (or confirm fax) and keep everything—your packet, mailing receipts, call log (agent ID, date/time), and any case number you receive. The paper trail matters.

7) What happens at a CDP hearing (and how Appeals evaluates your proposal)

CDP hearings are often conducted by phone. The Appeals Officer (AO) will verify that the IRS followed proper procedures and then evaluate whether the proposed levy is no more intrusive than necessary given your facts, or whether your alternative (installment, CNC, OIC, or lien relief) is a better fit. They will ask clarifying questions about your 433, your documentation, and your forward-looking compliance plan. If you filed timely, levy action for the covered periods is generally suspended during this review; if you filed late (Equivalent Hearing), you won’t usually have that protection. See CDP FAQs (https://www.irs.gov/appeals/collection-due-process-cdp-faqs).

Outcomes can include approval of your agreement, request for more documentation, a counterproposal (e.g., a slightly higher payment), or—if there’s a major mismatch between your numbers and your documents—denial. If you timely requested CDP and disagree with the determination, you can seek Tax Court review. That right is why timeliness is everything.

8) How levies are released (wage, bank) and how to mitigate damage if one lands

If a levy has already been issued (for example, a wage levy), one path to release is showing the IRS that your approved alternative is in place (agreement terms accepted and first payment made), or that the levy is creating a hardship inconsistent with IRS policy. The wage-levy exempt amount is computed by your employer using Publication 1494 (https://www.irs.gov/pub/irs-pdf/p1494.pdf) until a release arrives. For a broader view of collection steps and levy mechanics, see Publication 594 (https://www.irs.gov/pub/irs-pdf/p594.pdf) and the related levy guidance in the IRM, e.g., IRM 5.11.1 (https://www.irs.gov/irm/part5/irm_05-011-001) and IRM 5.17.3 (https://www.irs.gov/irm/part5/irm_05-017-003).

If your LT11/1058 is new and you file timely CDP, the goal is to avoid the levy entirely. If your LT11/1058 deadline slipped and a levy landed, you’ll need both the resolution (IA/CNC/OIC) and the release mechanics. The sooner you assemble your 433 and supporting documents, the faster the release conversation can happen.

9) CAP vs CDP: when to use the Collection Appeals Program (and when not to)

CDP gives you the strongest protection if it’s timely: levy action generally stops for the periods under appeal; you can take an unfavorable decision to Tax Court. CAP (Collection Appeals Program) is faster and can address specific actions, but it does not allow you to challenge the underlying liability and does not lead to judicial review if you disagree with Appeals. In short, CAP can be a quick tool for certain disputes, but CDP is the main event after LT11/1058. If the clock is still running on your LT11, CDP is almost always the better choice. For background, see the CDP FAQs (https://www.irs.gov/appeals/collection-due-process-cdp-faqs) and IRM sections like IRM 5.19.8 (https://www.irs.gov/irm/part5/irm_05-019-008).

If you missed the 30-day CDP deadline, an Equivalent Hearing is still possible within one year, or a CAP request could be used for certain actions—but understand the trade-offs: EH generally won’t pause levy, and CAP has no court review. (See CDP FAQs (https://www.irs.gov/appeals/collection-due-process-cdp-faqs).)

10) Common mistakes that sink LT11/1058 cases

- Waiting until day 29 to think about Form 12153. You’ll run out of time to assemble a credible 433 package.

- Throwing numbers at Form 433 without documentation. Appeals will test your math; if deposits don’t match, if expenses aren’t backed up, you lose credibility.

- Proposing a “heroic” monthly payment that you can’t keep up. Defaulting an agreement puts you right back in the line of fire—often with less patience from the IRS.

- Ignoring other periods not covered by the CDP request. The IRS can still act on those; a multi-year strategy needs to be explicit. See IRM 5.19.8 (https://www.irs.gov/irm/part5/irm_05-019-008) for policy context.

- Poor mailing discipline—no certified mail, no copies kept, no call-log. If a packet goes missing, you’ll need proof.

- Assuming a levy is automatic or conversely assuming nothing will happen. The risk is real, but you have tools—if you use them on time.

- Forgetting future compliance. Even a perfect plan collapses if new debt appears. Adjust withholding (W-4) or make estimates now.

11) The 48-hour stabilization plan (if your LT11 clock is ticking)

Hour 0–2: Triage and verify.

Confirm the notice is LT11/1058, note the notice date and tax periods, and calculate your 30-day deadline. Identify your viable lane: pay in full; streamlined IA; non-streamlined IA (needs 433 + documents); CNC; or OIC. Pull your bank balances and paystubs so you can size a realistic plan. Review Publication 594 (https://www.irs.gov/pub/irs-pdf/p594.pdf) for the collection process landmarks so your plan aligns with how the IRS operates.

Hour 2–12: Build the skeleton.

Fill Form 12153 and draft a one-page cover letter that states: (1) timely CDP request, (2) periods covered, (3) the relief you’re requesting, (4) that a 433 package and documents are enclosed (or arriving within X days). Begin Form 433-A/B and gather the bank statements, paystubs, bills, lease, insurance, etc. If you’re proposing an installment agreement, pick a number you can reliably make for the life of the plan. Download Form 12153 (PDF) (https://www.irs.gov/pub/irs-pdf/f12153.pdf).

Hour 12–24: Paper, proof, and submission plan.

Finish the 433 and compile documentation in logical order. Double-check that numbers reconcile. Prepare certified mail materials. If you’re urgently close to day 30, mail now to beat the clock, then send supplemental docs with a reference to your case when requested.

Hour 24–48: File and log.

Mail Form 12153 and packet to the hearing-request address on your notice (not the payment address). Save scans of everything. Start a call log with date/time, names/IDs, and notes from any IRS calls. If a levy rumor or action is looming for another period, strategize a separate, immediate contact (IRM references: IRM 5.11.1 (https://www.irs.gov/irm/part5/irm_05-011-001), IRM 5.17.3 (https://www.irs.gov/irm/part5/irm_05-017-003)).

12) Why Ed Parsons, CPA changes your odds

When you’re under an LT11/1058 deadline, the difference between panic and progress is process. This is what Ed Parsons, CPA brings to your side of the table:

- Transcript intelligence, not just downloads. Ed pulls account transcripts and reads status codes and module data that reveal what’s really happening—what’s assessed, when CSED clocks run, and where mismatches or misapplications may be hiding. He doesn’t stop at a surface read; he builds a timeline of assessments, penalties, prior notices, and events to spot opportunities (or traps) before you step in them.

- CSED mapping for strategy, not trivia. Knowing the Collection Statute Expiration Date by period shapes your proposal. A plan that quietly extends the statute without real benefit can cost you years; Ed evaluates whether a proposed agreement, OIC, or appeal will suspend or extend CSED and whether that trade makes sense in your case. For IRS process context, see Publication 594 (https://www.irs.gov/pub/irs-pdf/p594.pdf).

- A 433 that survives scrutiny. A Form 433 is only as good as its documentation and consistency. Ed builds packages that reconcile deposits, income, and expenses—so that when Appeals stress-tests your numbers, they hold. This is the difference between a fast approval and a frustrating ping-pong for “more info.”

- The right lane, sized to reality. Ed won’t let you sign up for a payment you can’t keep. He aims for installments that don’t default, CNC when hardship is legitimate and documented, or a properly-supported OIC when your Reasonable Collection Potential truly warrants it (see Offer in Compromise (https://www.irs.gov/payments/offer-in-compromise)).

- Appeals know-how & levy releases. In CDP, what and how you propose matters. Ed packages your relief in a way Appeals can adopt and keeps the process moving (including coordinating levy releases with employers/banks when a plan or hardship is approved). For wage levies, he also ensures the Publication 1494 (https://www.irs.gov/pub/irs-pdf/p1494.pdf) rules are applied correctly until the release arrives.

- Protection across periods. If other years are vulnerable outside your CDP request, Ed flags and addresses them—so you don’t fix one fire while another starts. The IRS can continue actions for periods not in Appeals; a global view prevents nasty surprises (see policy-level IRM 5.19.8 (https://www.irs.gov/irm/part5/irm_05-019-008)).

- Communication that shields you. Once properly authorized, Ed speaks to the IRS for you, tracks every contact, and turns chaotic requests into a single, coherent case file. You get breathing room—and a clear plan.

Ready to steady the situation and move forward? Start here: Contact Ed Parsons, CPA (https://edparsonscpa.com/contact/).

13) Advanced tactics that often matter (but most people miss)

A. Filing status & dependency proofs.

Wage levy exemptions hinge partly on your filing status and qualifying dependents for the year the levy is served. If your employer is unsure, your net pay can be smaller than necessary. Ed verifies the right status, ensures the employer received Publication 1494 (https://www.irs.gov/pub/irs-pdf/p1494.pdf), and makes sure the math is right while working the release.

B. Compliance lock-in.

An otherwise perfect installment agreement can fail if you under-withhold or miss quarterly estimates. Ed sizes your plan alongside W-4 adjustments or estimates so you don’t create a new balance that defaults your fresh agreement. For collection-process guardrails, see Publication 594 (https://www.irs.gov/pub/irs-pdf/p594.pdf).

C. Lien strategy during CDP.

Even if levy action is paused by a timely CDP, lien questions (file, withdrawal, subordination) may still be on the table. Ed frames lien decisions around your goals—home refi, business credit, or a pending property sale—and proposes the right relief where available. For liens generally, see Understanding a Federal Tax Lien (https://www.irs.gov/businesses/small-businesses-self-employed/understanding-a-federal-tax-lien).

D. Multi-entity and business cases.

If you own an S-corp or LLC, business cash flow and payroll compliance affect your personal plan. Ed coordinates Form 433-B (business) with your 433-A (individual) so Appeals sees a complete picture—especially crucial if trust-fund payroll taxes or a TFRP risk is lurking. For payroll tax collections context, see Collection Options for Delinquent Payroll Taxes (https://www.irs.gov/businesses/small-businesses-self-employed/).

E. Timing a narrow OIC vs. an installment.

An OIC isn’t always the right first move. Sometimes a well-structured non-streamlined IA that keeps you compliant and solvent is the best bridge; in other cases, your facts are ideal for OIC and filing sooner beats waiting. Ed models both, including how each path impacts CSED and practical cash flow. See the general collection overview in Publication 594 (https://www.irs.gov/pub/irs-pdf/p594.pdf).

14) If you already missed the 30-day CDP deadline

All is not lost. You can still request an Equivalent Hearing (EH) within one year of the notice date, or in some situations use CAP for specific actions. The trade-offs are real: EH generally won’t stop levy and it doesn’t preserve Tax Court review. CAP is often faster but, again, no court review and no challenge to the underlying liability in that channel. If a levy just hit, you’ll need to build your 433 quickly and present a plan or hardship that warrants a levy release. The faster your documents are clean and complete, the sooner a release is realistic. See CDP FAQs (https://www.irs.gov/appeals/collection-due-process-cdp-faqs).

If you’re up against the clock or a levy already landed, triage now with Contact Ed Parsons, CPA (https://edparsonscpa.com/contact/).

15) Employer and bank coordination during levies (what to expect)

For wage levies, your employer receives the levy plus Publication 1494 (https://www.irs.gov/pub/irs-pdf/p1494.pdf) and must compute the amount of your wages that are exempt from levy; you receive the exempt portion and the rest is sent to the IRS until a release is issued. Ed coordinates with both sides: confirming receipt, checking the computation, and pushing for the release once your alternative (IA/CNC/OIC) is accepted. For bank levies, the bank must hold funds for a short period and then send them to the IRS unless a release arrives in time; Ed works the release track while you stay focused on the documents. The IRM sections 5.11.1 (https://www.irs.gov/irm/part5/irm_05-011-001) and 5.17.3 (https://www.irs.gov/irm/part5/irm_05-017-003) provide policy context.

16) Documentation checklist (your CDP “go bag”)

- Form 12153, signed, with a copy of LT11/1058 attached (download the form here: Form 12153 (PDF) (https://www.irs.gov/pub/irs-pdf/f12153.pdf)).

- Cover letter: one page, clear ask, periods listed, and the relief sought.

- Form 433-A/B (as applicable) with support:

- Prior two–three months of bank statements (all accounts).

- Paystubs or contractor income proof; if self-employed, P&L and client receipts.

- Housing (lease/mortgage), utilities, insurance, medical, child care, court-ordered payments, transportation (loan, lease, gas, maintenance).

- Tax (withholding status, estimated tax receipts).

- Assets (retirement/brokerage statements, vehicle titles, real estate details).

- Compliance plan: W-4 change confirmation or estimated tax schedule.

- Certified mail receipts and a call log (date/time, names/IDs).

Aim for clarity, completeness, and consistency. If a number on Form 433 doesn’t match your documentation, fix it or explain it.

17) If you disagree with Appeals (and you filed timely)

A timely CDP request preserves your right to petition the U.S. Tax Court if you disagree with the Appeals determination. This is not a step to take lightly, but the right to judicial review is precisely why timely filing is so valuable—and why Ed is relentless about the calendar. See Collection Due Process (CDP) FAQs (https://www.irs.gov/appeals/collection-due-process-cdp-faqs).

18) Quick answers to the questions that keep you up at night

Q: Does LT11/1058 mean a levy is already scheduled?

A: No—LT11/1058 is the final notice that says levy is next unless you act. It’s also your official invitation to request a CDP hearing. If you file Form 12153 on time, levy action is generally suspended for the covered periods while Appeals reviews your case. See Understanding your LT11 notice or Letter 1058 (https://www.irs.gov/individuals/understanding-your-lt11-notice-or-letter-1058) and CDP FAQs (https://www.irs.gov/appeals/collection-due-process-cdp-faqs).

Q: If I send Form 12153, can the IRS still levy something else?

A: The CDP request typically protects the periods in the notice, but it doesn’t necessarily stop collection on other periods not in Appeals. Your representative must track and manage those so you don’t get blindsided elsewhere. See IRM 5.19.8 (https://www.irs.gov/irm/part5/irm_05-019-008).

Q: What if I truly can’t pay right now?

A: Request CNC hardship with a complete 433 and documentation showing that any payment would cause you to miss necessary living expenses. CNC stops active collection while interest accrues and the IRS may review later. See Publication 594 (https://www.irs.gov/pub/irs-pdf/p594.pdf).

Q: Should I try CAP instead of CDP?

A: After LT11/1058, timely CDP is usually superior: it can pause levy and preserves Tax Court review. CAP is faster for certain issues but has no court review and can’t contest the liability. If your 30-day clock is alive, CDP is typically the move. See CDP FAQs (https://www.irs.gov/appeals/collection-due-process-cdp-faqs).

Q: How much of my paycheck is safe if a levy hits?

A: Your employer uses Publication 1494 (https://www.irs.gov/pub/irs-pdf/p1494.pdf) tables to compute the exempt portion based on your filing status and dependents; you keep the exempt amount until a release is issued. This is why preventing the levy—or getting a quick release—matters.

19) When to bring in Ed Parsons, CPA (and what happens next)

If you’re inside the LT11/1058 window, earlier is better. Here’s the typical onboarding flow with Ed:

- Rapid assessment call to triage your notice(s), dates, periods, and any active levy risk.

- Transcript pull and CSED map, so the plan we propose aligns with statute realities. (See policy-level process in Publication 594 (https://www.irs.gov/pub/irs-pdf/p594.pdf).)

- Decision meeting on the best lane (IA/CNC/OIC), sized to your cashflow and risk tolerance, not a cookie-cutter default.

- Document sprint: Ed’s team builds the 433 package, reconciles the paper trail, and drafts the Form 12153 packet and cover letter (download Form 12153 (PDF) (https://www.irs.gov/pub/irs-pdf/f12153.pdf)).

- Filing and case tracking: certified mail, fax confirmations, and a live call log. Ed becomes the voice on the phone with the IRS so you don’t have to be.

- Appeals handling: Ed handles the hearing, responds to document requests, negotiates fine points, and coordinates levy releases if needed (wage/bank). He ensures the Publication 1494 (https://www.irs.gov/pub/irs-pdf/p1494.pdf) rules are applied correctly until the release arrives.

- Compliance lock-in so a new balance doesn’t undo your progress (withholding or estimates dialed in).

You don’t need a miracle; you need method. That’s what Ed brings when the stakes are highest. Ready to move? Contact Ed Parsons, CPA (https://edparsonscpa.com/contact/).

20) Final word: LT11/1058 is urgent—but it’s also your opening

Most people see LT11/Letter 1058 and freeze. Don’t. This is the moment to assert your rights, document your reality, and choose a resolution that the IRS will accept and you can sustain. With a timely CDP (Form 12153), a clean 433 package, and a representative who knows this terrain, you can prevent a levy—or get one released quickly—and move on with a plan that fits your life.

If you’re holding an LT11/1058 now, take the next step: get your timeline, your documents, and your strategy in order. Bring in Ed Parsons, CPA to execute the plan with precision and get you out from under the threat of levy—for good. Start here (https://edparsonscpa.com/contact/).

Supplemental IRS References (optional reading)

- Understanding your LT11 notice or Letter 1058 (https://www.irs.gov/individuals/understanding-your-lt11-notice-or-letter-1058)

- Collection Due Process (CDP) FAQs (https://www.irs.gov/appeals/collection-due-process-cdp-faqs)

- Form 12153 (PDF) — Request for a Collection Due Process or Equivalent Hearing (https://www.irs.gov/pub/irs-pdf/f12153.pdf)

- Publication 594 (PDF) — The IRS Collection Process (https://www.irs.gov/pub/irs-pdf/p594.pdf)

- Publication 1494 (PDF) — Wage levy exempt amount tables (https://www.irs.gov/pub/irs-pdf/p1494.pdf)

- IRM 5.11.1 — Pre-levy actions/restrictions (https://www.irs.gov/irm/part5/irm_05-011-001)

- IRM 5.17.3 — Levy and sale (https://www.irs.gov/irm/part5/irm_05-017-003)

- IRM 5.19.8 — Collection appeal rights (https://www.irs.gov/irm/part5/irm_05-019-008)

- Understanding a Federal Tax Lien (https://www.irs.gov/businesses/small-businesses-self-employed/understanding-a-federal-tax-lien)

Need help right now? Contact Ed Parsons, CPA (https://edparsonscpa.com/contact/)