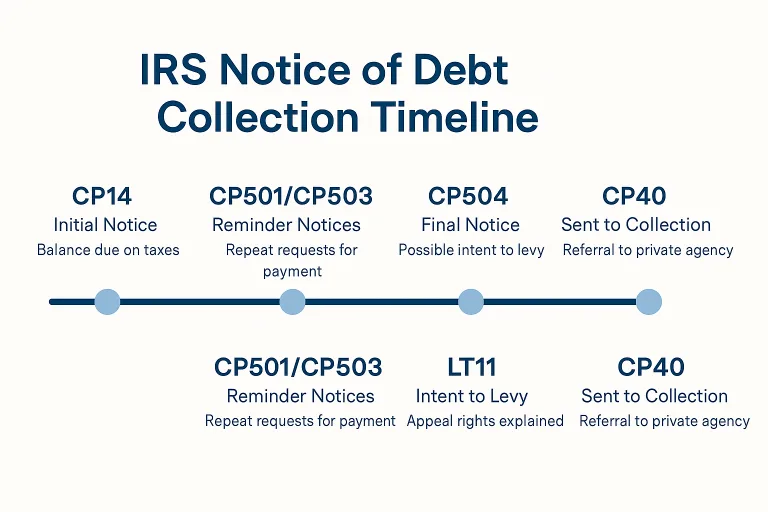

CP40 Notice:“Why Did the IRS Send Me to a Debt Collector?”

The IRS CP40 notice means your unpaid tax debt has been assigned to a private collection agency. While CP40 doesn’t affect your credit directly, ignoring it can trigger escalating enforcement. Learn what this notice really means, how to verify legitimacy, and why professional CPA guidance makes the difference when collectors call.

CP40 Notice:“Why Did the IRS Send Me to a Debt Collector?” Read More »